Through the Lens- Fixed Income Update Jan 2021 By Murthy Nagarajan, Tata Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Through the Lens- Fixed Income Update Jan 2021 By Murthy Nagarajan, Tata Mutual Fund

RBI Liquidity Withdrawal

* RBI announced, “resumption of normal liquidity management operation” and announced a variable rate 14-day reverse repo of INR 2 trillion.

* Usage of words “resumption” and “phased” in the release would denote that this is not a one-off phenomenon and that RBI would use it in a calibrated manner on a continuous basis.

* The announcement spooked the markets and short-term curve, which was trading at extremely low levels (overnight rates to 3-month T-bill rates were significantly below Reverse Repo rates), saw immediate sell offs.

* While this would mean that RBI can be more flexible with OMO purchases without having to worry about liquidity implications, long term yields could still witness sharp reaction as market might take it as a signal.

The short term curve and medium term curve (3 month to 5 years) have taken a significant knock post RBI liquidity normalisation announcement. This has led to flattening of curve (short term rates have inched up much more than long term rates).

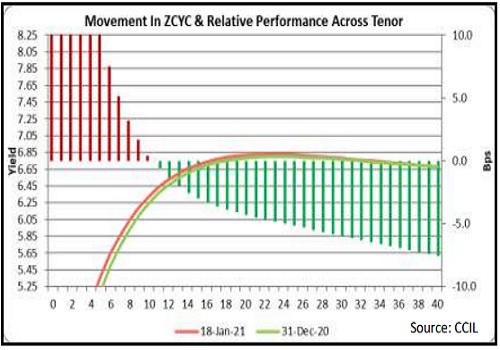

Interest Rate Yield Curve Movement (Jan 2021 – 18th Jan 2021 – post RBI liquidity management announcement)

Short Term Yield Curve

Post the RBI Announcement that they will resume normal liquidity management operations, there was a sharp spike in yields of shorter-term securities, with yields in the 0-5-year segment rising by up to 10-40 bps. The Yield curve saw upward movement in the shorter end.

Long Term Yield Curve

Yields in the 5-10-year segment rose by 0-10 bps as a consequence of the RBI announcement, while yields of 10-year and above instruments continued to fall by up to 10 bps. The Yield curve saw some steepening in the shorter end, while the longer end remained stable.

PS: The bars in the charts show the extend of yield movements, while the x-axis show the tenor of the instruments

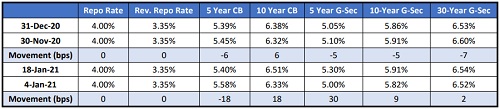

Recent Rate Movements*

Movement of Short-Term Rates

Yields of short-term CDs rose by 10-15 bps in December-20, while yields of short-term corporate bonds fell by 5-10 bps.

In January-21, yields of short-term CDs rose by 15 bps, while yields of short-term corporate bonds rose by 18 bps.

Movement of Long-Term Rates

Yields of corporate bonds in the 5-year segment fell by 6 bps in December-20, while yields rose by 6 bps in the 10-year segment. Long-term G-Sec yields in (5-30-years) fell by 5-7 bps.

In January-21, yields of corporate bonds in the 5-year segment fell by 18 bps, while yields rose by 18 bps in the 10-year segment. G-Sec yields in the 5-10-year segment rose by 10-30 bps, while longer term yields moved comparatively little.

Outlook on Rates Going Ahead

* We do not expect any more rate cuts by RBI, ending the cycle of easing rates.

* RBI stance is likely to remain accommodative for CY2021.

* RBI is expected to continue with OMO purchases of G-Sec and SDL’s

* Yield curve may inch-up as markets take latest RBI move as a signal.

* Yield curve is expected to flatten as short-term rates see sell-offs.

* RBI has announced it will gradually return to normal Monetary Policy and remove abundantly surplus liquidity. However, liquidity is likely to remain positive still.

* RBI is expected to conduct variable rate reverse repos, hike CRR, and take a policy to neutral stance traversing through FY-22.

Macro Update

Consumer Price Inflation (CPI)

* CPI for the month of December cooled off sharply to 4.6% YoY against 6.9% YoY in November, primarily on account of sharp fall in food prices.

* Food inflation eased to 3.9% in Dec-20 from 8.9% in Nov-20. On a sequential basis, food momentum contracted by 2.7% in Dec-20 lower than the seasonal momentum of -0.54% (average of last 5 years) led by a drop in vegetable prices (- 15.7% MoM), cereal prices (-0.75%) and meat prices (-0.47%).

* Core Inflation remained flat at 5.5% in Dec-20. On a sequential basis, ‘Health’, ‘Transport and Communication’, ‘Recreation and Amusement’ held up while ‘Personal care and effects’ contracted. Even after removing gold, core inflation remained sticky at 5.0%.

* We expect CPI inflation to ease in the coming months on account of sharp correction in vegetable prices and meat and poultry prices due to the spread of the bird flu. For Jan 2021, we expect inflation to fall further to around 4.5%-5.0%. For Q4 FY21, we expect inflation to average in the range of 4.6%- 4.8%. While, near term inflation outlook has turned favourable, risks remain emanating from rising fuel and commodity prices, improvement in demand condition and pricing power.

* On the policy front, the current readings would provide comfort to RBI w r t inflation trajectory but would not lead to any change in Monetary Policy. We expect RBI to remain accommodative in near term.

Index of Industrial Production (IIP)

* November industrial production growth surprised to the downside (-1.9%yoy), while the October print was raised to 4.2%yoy, from 3.6%yoy reported earlier.

* An unfavorable base and sequential slowdown (IIP was down -1.2% m-o-m in Nov vs. +2.8%mom in Oct on a seasonally adjusted basis) were responsible for the downside surprise, though we had expected IP growth to turn negative in November.

* Manufacturing output (-1.7% YoY in November) slipped into negative growth after rising in October. The output of goods catering to consumer demand fell only slightly by 0.7% YoY in November, after an impressive 11.6% YoY growth in October. On the other hand, goods catering to industrial demand – i.e., capital goods (-7.1% YoY) and intermediate goods (-3.0% YoY) saw steeper declines after witnessing a brief rebound in October.

Trade

* India’s trade deficit has widened sharply to USD15bn in Dec’20, from USD9-10bn levels in the previous two months.

* As per the preliminary trade data, imports growth turned positive in Dec’20 (+7.6%yoy), but more notably, non-oil-non-gold imports also turned sharply positive last month (+8%yoy), for the first time since Feb’20.

* Even on a 3-month-moving-average basis, non-oil-non-gold imports have turned positive in Dec’20 (+0.5%yoy), which reflects continued normalisation of domestic demand in the economy.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">