Kotak Mahindra Bank Announces Q3FY21

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Kotak Mahindra Bank Standalone PAT for Q3FY21 Rs.1,854 crore, up 16% yoy;

Consolidated PAT Rs.2,602 crore, up 11% yoy

Mumbai, 25th January, 2021: The Board of Directors of Kotak Mahindra Bank (“the Bank”) approved the unaudited standalone and consolidated results for Q3FY21, at the Board meeting held in Mumbai, today.

Kotak Mahindra Bank standalone results

The Bank’s pre-tax profit for Q3FY21 was Rs.2,484 crore, up 28% from Rs.1,944 crore in Q3FY20.

The Bank’s PAT for Q3FY21 increased to Rs.1,854 crore from Rs.1,596 crore in Q3FY20, up 16%. In Q3FY20, the provision for tax was lower due to some favourable tax orders.

Net Interest Income (NII) for Q3FY21 increased to Rs.4,007 crore, from Rs.3,430 crore in Q3FY20, up 17%. Net Interest Margin (NIM) for Q3FY21 was at 4.51%.

CASA ratio as at December 31, 2020 stood at 58.9% compared to 53.7% as at December 31, 2019.

Average Savings deposits grew by 29% to Rs.107,363 crore for 9MFY21 compared to Rs.83,049 crore for 9MFY20. Average Current Account deposits grew by 13% to Rs.37,533 crore for 9MFY21 compared to Rs.33,258 crore for 9MFY20.

CASA and TDs below Rs.5 crore as at December 31, 2020, constituted 92% of total deposits (87% as at December 31, 2019). TD Sweep deposits as at December 31, 2020 were 8.1% of total deposits (7.4% as at December 31, 2019).

Advances as at December 31, 2020 were at Rs.214,103 crore (Rs.204,845 crore as at September 30, 2020 and Rs.216,774 crore as at December 31, 2019). Customer Assets, which includes Advances and Credit substitutes, were Rs.228,809 crore as at December 31, 2020 (Rs.218,790 crore as at September 30, 2020 and Rs.227,206 crore as at December 31, 2019).

Operating profit for Q3FY21 was Rs.3,083 crore, up 29% from Rs.2,388 crore in Q3FY20.

COVID related provisions as at December 31, 2020 stood at Rs.1,279 crore. In accordance with the Resolution Framework for COVID-19 announced by RBI on August 6, 2020, as at December 31, 2020, the Bank has approved, for certain eligible borrowers, one-time restructuring of 0.28% of net advances.

As at December 31, 2020, GNPA was 2.26% & NNPA was 0.50%. The Bank has not classified any NPAs since August 31, 2020, basis the interim order of Hon. Supreme Court. Had the Bank classified the borrowers more than 90 days overdue on December 31, 2020 as NPA, GNPA would be 3.27% (September 30, 2020: 2.70%); NNPA would be 1.24% (September 30, 2020: 0.74%). The Bank has, however, made provision for such advances including towards interest accrued but not collected for the entire period, with moratorium.

Capital adequacy ratio of the Bank as per Basel III, as at December 31, 2020 was 21.5% and Tier I ratio was 20.9%.

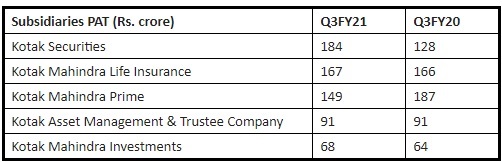

Consolidated results at a glance

Consolidated PAT for Q3FY21 increased to Rs.2,602 crore from Rs.2,349 crore in Q3FY20 up 11%.

For Q3FY21, the Bank’s contribution to the consolidated PAT was Rs.1,854 crore. The subsidiaries & associates net contribution was 29% of the consolidated PAT.

The contribution of key subsidiaries is given below:

AUM (Policyholders’) of Kotak Mahindra Life Insurance as at December 31, 2020 grew 21.7% YoY to Rs.39,770 crore.

The Relationship Value of the customers of Wealth, Priority Banking and Investment Advisory was ~ Rs.375,000 crore as at December 31, 2020 up 22% from ~ Rs.306,000 crore as at December 31, 2019.

Consolidated Networth as at December 31, 2020 was Rs.81,616 crore (Rs.64,518 crore as at December 31, 2019). The Book Value per Share was Rs.412.

Consolidated Customer Assets, including Advances and Credit Substitutes, were Rs.255,786 crore as at December 31, 2020 (Rs.247,432 crore as at September 30, 2020 and Rs.261,410 crore as at December 31, 2019).

Total assets managed / advised by the Group crossed Rs 300,000 crore. As at December 31, 2020 they were at Rs.314,833 crore up 20% over Rs.263,256 crore as at December 31, 2019.

The financial results of the subsidiaries and associates used for preparation of the consolidated financial results are in accordance with Generally Accepted Accounting Principles in India (‘GAAP’) specified under Section 133 and relevant provision of Companies Act, 2013. The financial statements of Indian subsidiaries (excluding insurance companies) and associates are prepared as per Indian Accounting Standards in accordance with the Companies (Indian Accounting Standards) Rules, 2015.

Above views are of the author and not of the website kindly read disclaimer