Key indices end Tuesday's volatile session on positive note

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian equity benchmarks ended Tuesday's volatile session on a positive note with gains of over half a percent each, following gains in index majors Ultratech Cement, Indusind Bank and ICICI Bank despite a weak trend in global markets. The benchmarks made positive start and stayed in green for most part of the day, as traders took encouragement as FICCI's latest quarterly survey on manufacturing assessed recovery of the sector for Q-3 (October-December 2020-21) and pointed that it is expected to regain the lost momentum in the Q-4. However, key gauges trimmed initial gains in late morning deals, as some cautiousness came with a private report that the pandemic-induced shocks to the economy which have already shaved off 15.7 per cent of the GDP from the previous year, will delay the ambitious target of becoming the third largest economy by three years to 2031-32 now. Traders also took a note of the Reserve Bank of India’s (RBI) statement that the government has decided to cancel its Rs 20,000 crore borrowing scheduled for March 26, 2021 on review of cash balance position. This means, the government would be borrowing Rs 20,000 crore less than its target of Rs 12.8 lakh crore announced in the Budget on February 1 for the current fiscal.

However, markets regained some traction in late afternoon deals, as overall capacity utilization in manufacturing has witnessed a rise to 74 per cent as compared to 65 per cent in previous quarter. The future investment outlook, however, looks slightly better as 30 per cent respondents reported plans for capacity additions for the next six months as compared to 18 per cent in the previous quarter. Market participants overlooked a private report stating that the 'second wave' of the pandemic is delaying business normalization in the country, as coronavirus infections rise in Maharashtra and other states. The Nomura India Business Resumption Index dipped to 95.1 for the week to March 21 from 95.4 in the previous week as a result of the rising infections. Meanwhile, former RBI Deputy Governor Rakesh Mohan pitched for changing the central bank's inflation target band of 2-6 per cent, saying inflation will not take off as long as the government is doing proper macroeconomic management.

On the global front, European markets were trading lower as tensions between China and the west escalated and German leaders agreed to extend the country's coronavirus lockdown until April 18 to contain a new wave of infections. Besides, official data showed Britain's jobless rate unexpectedly fell to 5.0 percent in the three months to January, when the country entered a new virus lockdown. That was below economists' forecast of 5.2 percent. Asian markets ended mostly in red, after a coalition of western nations announced sanctions on Chinese officials for alleged human rights abuses against Uyghur Muslims. China immediately announced retaliatory sanctions against the EU that appeared broader. Back home, on the sectoral front, logistic stocks were in focus as India Ratings and Research (Ind-Ra) said that India’s logistics sector looks stable in financial year 2021-22 as a recovering economy builds demand, citing the commissioning of a dedicated freight corridor. There was some reaction in banking stocks as the Supreme Court of India gears up to pronounce the verdict on various pleas that seek an extension of the loan moratorium that was announced almost a year ago. The pleas before the apex court are from various trader associations. Earlier the government had informed the court that if the interest on all loans and advances was to be waived the amount lost would be close to Rs 6 lakh crore.

Finally, the BSE Sensex rose 280.15 points or 0.56% to 50,051.44, while the CNX Nifty was up by 78.35 points or 0.53% to 14,814.75.

The BSE Sensex touched high and low of 50,264.65 and 49,661.92, respectively. There were 16 stocks advancing against 14 stocks declining on the index.

The broader indices ended in green; the BSE Mid cap index rose 0.95%, while Small cap index was up by 0.75%.

The top gaining sectoral indices on the BSE were Bankex up by 1.51%, Industrials up by 1.16%, Energy up by 1.06%, Realty up by 1.05% and Finance up by 0.93%, while Metal down by 0.74%, FMCG down by 0.45%, Oil & Gas down by 0.45% and Telecom down by 0.06% were the losing indices on BSE.

The top gainers on the Sensex were Ultratech Cement up by 3.06%, Indusind Bank up by 2.28%, ICICI Bank up by 2.25%, HDFC Bank up by 2.11% and Titan Company up by 2.06%. On the flip side, ONGC down by 2.28%, Power Grid down by 1.97%, ITC down by 1.70%, NTPC down by 1.14% and Mahindra & Mahindra down by 1.05% were the top losers.

Meanwhile, India Ratings and Research (Ind-Ra) has said India’s logistics sector looks stable in next financial year (FY22) as a recovering economy builds demand. It estimates an 8 per cent year-on-year improvement in volumes for Indian ports in FY22, compared to an estimated 4 per cent year-on-year decline in FY21. The 8 per cent year-on-year rise will be led by private ports, which in five years have displayed a median multiplier (vs real GDP growth rate) of 1.4x, thus outperforming growth from major ports. India’s ports volumes closely follow the country’s GDP growth, with container growth coming in 2x of overall cargo volumes.

Domestic air travel, which has continued to recover in 2HFY21, is expected to strengthen in FY22, though the risk to this view arises from a second wave of Covid-19. Both corporate and domestic travel demand are already showing signs of revival, which has helped support load factors and yields, while cargo volumes are expected to rise amid stronger macro-economic fundamentals and e-commerce push. Ind-Ra forecasts domestic passenger numbers to rise 10 per cent in FY22 (over FY20) implying a GDP multiplier of 0.9x, lower than the 2.4x (median estimate) for the FY15-FY20 period.

For inland container depot/container freight station operators, it forecasts a healthy pickup in volumes though competition remains intense and realisations remain soft. The reduced dwell time after the commissioning of Dedicated Freight Corridor and increased double stacking volume will support higher operating efficiencies, which is likely to support EBITDA margins in FY22-FY23. For warehouses, Goods and Services Tax led consolidation and rationalisation of occupancy rates could continue in FY22.

The CNX Nifty traded in a range of 14,878.60 and 14,707.00. There were 27 stocks advancing against 23 stock declining on the index.

The top gainers on Nifty were Shree Cement up by 4.68%, Ultratech Cement up by 2.70%, Divis Lab up by 2.57%, HDFC Bank up by 2.37% and Indusind Bank up by 2.32%. On the flip side, Hindalco down by 2.43%, ONGC down by 2.14%, Power Grid down by 2.06%, GAIL India down by 1.86% and ITC down by 1.77% were the top losers.

European markets were trading lower; UK’s FTSE 100 decreased 34.23 points or 0.51% to 6,691.87, France’s CAC fell 40.17 points or 0.67% to 5,928.31 and Germany’s DAX was down by 82.40 points or 0.56% to 14,574.81.

Asian markets ended mostly lower on Tuesday, as the investors are in cautious outlook in midst of tensions between western nations and China. Western nations had imposed sanctions on Chinese officials for human rights abuses in Xinjiang, while Beijing hit back immediately with broad punitive measures against the EU. Asian share got pressured with the steep declines in Chinese stocks and high volatility in US bond yields.

Above views are of the author and not of the website kindly read disclaimer

Top News

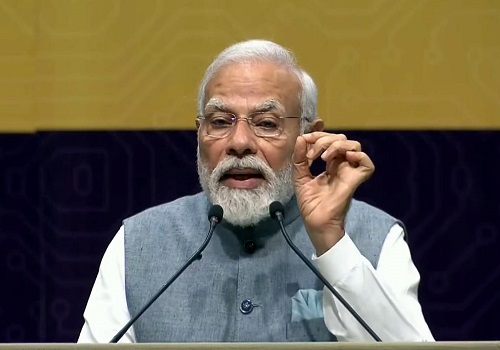

India`s electronics manufacturing jumps from $30 bn to $100 bn: Prime Minister Narendra Modi

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Nifty opened on a positive note and extended buying momentum in the first half however selli...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">