Key News - Indian Hotels Company Ltd, TVS Motor Company Ltd, Indian Energy Exchange Ltd, LIC Housing Finance Ltd, By ARETE Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Key News

Indian Hotels' net loss narrows to Rs 130 cr in Q2 on strong recovery

Tata group hospitality firm Indian Hotels Co Ltd (IHCL) on Thursday said it's losses for the September quarter narrowed year on year on the back of recovery of demand, especially in leisure destinations. Consolidated net loss at the owner of Taj, Ginger, Vivanta among other brands reduced to Rs 130.92 crore against a net loss of Rs 252.09 crore in the year-ago period. "Most leisure destinations have seen a very strong demand. Palace properties have exceeded our expectations, " Puneet Chhatwal, managing director and chief executive officer, IHCL told investors in a post earnings conference call.

TVS Motor consolidated net profit rises 29% in Sept quarter to Rs 234 cr

Two- and three-wheeler maker TVS Motor Company, the flagship company of Chennai-based TVS Group, has posted a 29 per cent increase in consolidated net profit for the second quarter of the financial year ended on September 30 to Rs 234.37 crore as compared to Rs 181.41 crore during the same period in 2020-21 owing to a rise in sales. The company’s revenue from operations was also seen up by 23 per cent to Rs 6,483 crore during the period under review, as against Rs 5,254 crore during the same period during the last financial year.

IEX Q2 net profit up 75% to Rs 77 crore; announces bonus issue

The Indian Energy Exchange (IEX) on Thursday posted a nearly 75 per cent jump in consolidated net profit at Rs 77.38 crore for the September quarter, mainly on the back of higher revenues. The consolidated net profit of the company stood at Rs 44.33 crore in the corresponding quarter of the previous fiscal, it said in a BSE filing. Total income rose to Rs 122.30 crore in the quarter from Rs 78.71 crore in the year-ago period. The board in its meeting on Thursday recommended a bonus issue of equity shares in the proportion of two shares of Re 1 each for every one existing share of Re 1 each held by the shareholders as on the record date.

LIC Housing Finance Q2 net down 69%; impairment expenses rise sharply

LIC Housing Finance Ltd’s net profit declined by 68.7 per cent to Rs 247.86 crore in the second quarter ended September 2021 (Q2Fy22) on fall in interest income and sharp rise in expenses for impairments. It had posted a net profit of Rs 790.9 crore in Q2Fy21. Its net interest income (NII) for the reporting quarter fell by 5.25 per cent to Rs 1,173 crore from Rs 1,238 crore in the second quarter of last year (Q2Fy21). The net interest margin moderated from 2.34 per cent in Q2Fy21 to 2.0 per cent in Q2Fy22.

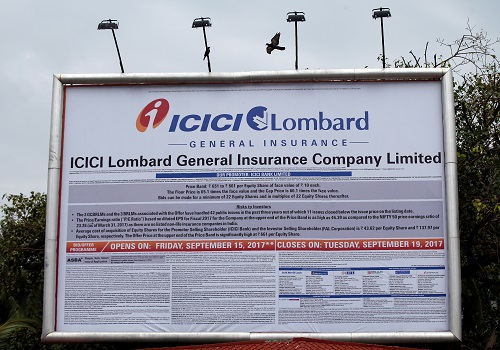

ICICI Lombard reports marginal increase in net profit at Rs 446 cr in Q2

Private sector insurer ICICI Lombard General Insurance reported a net profit of Rs 446 crore in the July - September quarter (Q2) of FY22, marginally higher than the last year’s net profit of Rs 416 crore. But on a sequential basis, the net profit has more than doubled. The general insurer’s gross direct premium rose by 38.72 per cent on a year-on-year (YoY) basis to Rs 4,424 crore in Q2FY22 compared to Rs 3,189 crore in Q2FY21. As the company has merged Bharti Axa General Insurance business with itself, the numbers are not comparable with the previous year’s numbers.

JSW Steel Q2 consolidated net profit rises 350% to Rs 7,170 crore

Sajjan Jindal-led JSW Steel today reported highest ever consolidated net profit of Rs 7,179 crore in the quarter ending September 30, 2021, up 350 percent from same period last year on increased revenue. The company also reported highest ever quarterly revenue from operations at Rs 32,503 crore and highest ever quarterly operating EBITDA of Rs 10,417 crore

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

``ICICI Lombard Unveils `Cloud Calling' Feature, Transforming Motor Claims Interaction and A...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">