Investment options that help you save tax

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

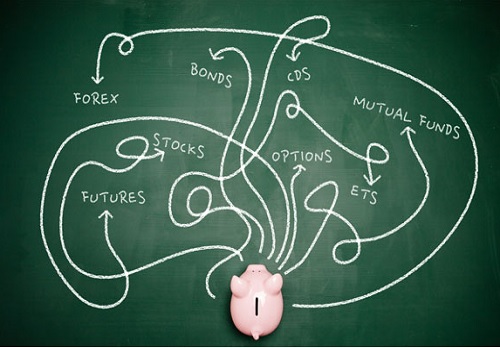

Who doesn’t want to save taxes on their hard-earned income? This is particularly why you are certain to find a number of income tax saving investment options and instruments available in the market to help you reduce your tax burden. While some offer incredibly high returns while others offer a comfortable cushion for your post-retirement plans. Whatever your specific financial needs may be, there is possibly an income tax saving option for you out there.

But, keeping in mind the most popular financial needs except this, here are some of the best tax saving investments that you should definitely know about:

- ELSS Mutual Fund: The primary objective of any investment option is to help you grow your wealth. But what if your investment returns could help you save taxes too? Mutual funds, one of the most popular investment options in India, gets this additional income tax saving benefit in the form of Equity-Linked Saving Schemes, known simply as ELSS.

Essentially, ELSS is an open-ended mutual fund scheme that has a lock-in period of 3 years and offers returns to the tune of 12 to 18 percent. However, what makes this one of the best tax saving investments is the tax benefits it offers. Under Section 80C of the Income Tax Act, the amount invested in an ELSS fund has a tax exemption limit as high as Rs. 1.5 lakh, thereby considerably reducing your tax burden. Moreover, with the ELSS fund, long term capital gains of upto Rs. 1 lakh will also be exempted from tax.

- National Pension Scheme: An incredibly effective income tax saving investment that also doubles as a reliable safety net for retirement is the government-initiated National Pension Scheme, or NPS. Employees across sectors, ranging from public to private to even unorganized sectors, can make the most of this nationwide scheme. The regular investments contributed to the NPS during your employment not only help build a corpus for your post-retirement life, but also offer a host of income tax saving benefits.

Firstly, your NPS contributions are eligible for a tax deduction of upto Rs. 1.5 lakh, under Section 80C. Secondly, you can claim an additional deduction of upto Rs. 50,000 as self-contribution. Lastly, if 10 percent of your base salary is contributed by your employer under the National Pension Scheme, that amount cannot be taxed under income tax laws.

- Public Provident Fund: Public Provident Fund, or PPF, continues to be one of the best income tax saving investments available for the generation of employees. While its interest rate is subject to vary every quarter, its returns and the many tax benefits it offers remain guaranteed and relied upon by people across the nation.

Similar to the options mentioned above, this income tax saving investment is tax exempted for up to Rs. 1.5 lakh. But its greatest income tax saving benefits lies in its status as an EEE investment, that is Exempt, Exempt and Exempt. This means that the contributions to the PPF, the interest returns from it and the maturity earnings from it are all exempted from tax. No wonder it is the most popular and often considered one of the best tax saving benefits for Indian employees across all sectors.

- The right insurance plans: While we typically associate investments with means of growing our wealth, there is also another form of investment we often fail to consider. These include investments into our future and in preparing for a worst-case scenario to safeguard our finances and family. That is where insurance plans come in and what’s more, they also double as an income tax saving investment in the long run.

For instance, the premiums towards a term insurance plan are eligible for tax benefits under Section 80C and 10(10D) of the Income Tax Act. If your term insurance comes with a medical rider, you can even avail additional tax benefits under Section 80D. Browse the website to know more about Life Insurance and the various Term Plans offered by PNB MetLife.

So, now that you know of the best tax saving investments in the market, make sure to make the most of these investment opportunities and reduce your income tax burden. Always ensure to do a proper and thorough round of research before opting for the investment option that works best for you and enjoy your tax benefits for years to come.

Disclaimer:

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited, Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka.

IRDAI Registration Number 117. CI No: U66010KA2001PLC028883. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding the sale.

The marks “PNB” and “MetLife” are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969. Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203

AD-F/2019-20/00225

BEWARE OF SPURIOUS/FRAUD PHONE CALLS!

• IRDAI is not involved in activities like selling policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">