Inflation spikes back to 5.5% in Mar`21 and IIP shrinks 3.6% YoY in Feb`21 By Nikhil Gupta, Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

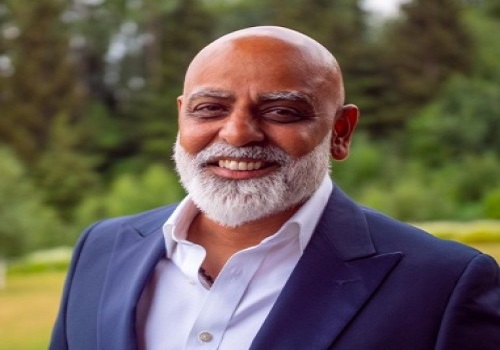

Below are Views On Inflation spikes back to 5.5% in Mar`21 and IIP shrinks 3.6% YoY in Feb`21 By Mr. Nikhil Gupta, Chief Economist at Motilal Oswal Financial Services

Inflation spikes back to 5.5% in Mar'21 and IIP shrinks 3.6% YoY in Feb'21 Data points were largely on expected lines

-- As expected, retail inflation surged back to 5.5% YoY last month vis-a-vis 5% in Feb'21 and 4.1% in Jan'21. Core inflation also surged to 29-month high of 5.7% in Mar'21.

-- Food inflation (39% weight) rose to 4-month high of 4.9% YoY in Mar'21, broadly in line with our forecast of 4.7%.

-- Separately, India's IIP contracted for third time in Feb'21 in the last four months - the worst fall of 3.6% YoY in six months. It was slightly worse than the market consensus of -3%, but not way off. Capital goods declined 4.2% YoY in Feb'21, while intermediate/infra sectors fell 7-7.5% during the month.

Overall, while both data worsened vis-a-vis previous month, there were no surprises. Going forward, CPI is likely to ease to <5% (7.2% in Apr'20) in Apr'21 and IIP could grow ~20% YoY in Mar'21 (-18.6% YoY in Mar'20) due to base effect.

On annual basis, CPI inflation/IIP is expected to average 4.7%/11.1% in FY22 v/s 6.2%/-8.7% in FY21. Above views are of the author and not of the website kindly read disclaimer

Above views are of the author and not of the website kindly read disclaimer

Top News

Centre to release Rs 95,082 crore as tax devolution to states in November: Nirmala Sitharaman

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">