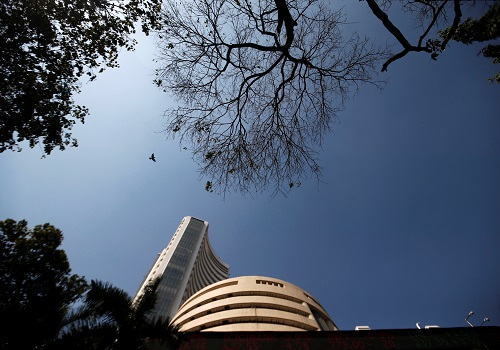

Indian shares, rupee plunge as Russia attacks Ukraine

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BENGALURU -Indian shares led sharp losses in Asia and the rupee suffered its worst session in more than 10 months on Thursday, after Russia's invasion of Ukraine sent oil prices soaring and fanned inflation fears.

Russian forces invaded Ukraine by land, air and sea, confirming the worst fears of the West with the biggest attack by one state against another in Europe since World War Two, sending global markets into a tailspin.

Heavy losses across sectors drove the blue-chip NSE Nifty 50 index 4.78% lower to 16,247.95, while the S&P BSE Sensex slid 4.72% to 54,529.91. Both indexes marked their worst session since May 2020 when the pandemic had roiled markets.

The Indian stock market was the worst performer in Asia on Thursday and clocked its worst losing streak since March 2020, with seven straight sessions of losses.

The rupee weakened 1.5% to 75.65 against the dollar, compared with Wednesday's close of 74.555.

"The looming risk of this (Ukraine) crisis is no more there, it is a reality today," said Aishvarya Dadheech, a fund manager at Ambit Asset Management, adding that a rise in commodity prices and inflation could adversely impact the country.

"High crude prices could delay the cool-off in inflation, which was expected to go moderate by the second half of 2022," said Naveen Kulkarni, chief investment officer at Axis Securities, adding that the volatility will stay for some time.

Oil prices breached $100 a barrel for the first time since 2014, raising fears of heightened inflation and wider current account deficit in the world's third-largest importer of oil. [O/R]

Nifty's volatility index, which indicates the degree of volatility traders expect over the next 30 days in the Nifty 50, saw its biggest spike since mid-March 2020.

The Nifty public sector bank index suffered the sharpest loss among sub-indexes, plunging 8.3%.

Tata Motors slumped 10.3% and was the biggest decliner on the Nifty 50.

Top Indian pharma firms, including Dr. Reddy's Laboratories and Sun Pharma, which have significant business exposure in Russia and European markets, fell 2.6% each.

(Reporting by Rama Venkat, Chris Thomas and Nallur Sethuraman in Bengaluru; Additional reporting by Gaurav Dogra; Editing by Subhranshu Sahu, Shounak Dasgupta and Vinay Dwivedi)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">