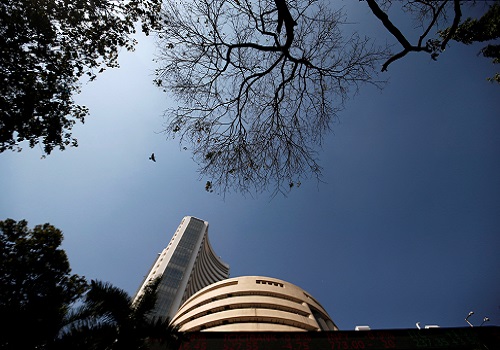

Indian shares post worst losing streak in four years

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian shares registered their longest losing streak in nearly four years on Tuesday, amid persistent rate hike fears and sustained foreign selling, ahead of the domestic GDP data for the December quarter.

The Nifty 50 index fell 0.51% to 17,303.95, while the S&P BSE Sensex closed 0.55% lower to 58,962.12. Both benchmarks declined for the eighth consecutive session, with the Nifty 50 falling 4.1% over the period.

Seven of the 13 major sectoral indexes declined with high weightage financials and information technology falling 0.07% and 0.85%, respectively.

Auto stocks bucked the trend, adding nearly 0.5% ahead of the monthly sales numbers, due on Wednesday.

The benchmarks also shed nearly 2% in February, extending their monthly losing streak and ending the month with a red candle for the third time in a row.

On five similar occasions in the past, the Nifty 50 rebounded and logged gains in the next two successive months. "This time it is different," said Neeraj Dewan, director at Quantum Securities.

"The markets may see some buying over the next few sessions after the ongoing sustained selling, but there won't be a clear rebound till we get some respite on the inflation front."

Foreign portfolio investors have so far offloaded 325.18 billion rupees ($3.93 billion) worth of Indian equities in 2023.

"A reality check for markets," said Pramod Gubbi, co-founder of Marcellus Investment Managers, referring to the recent U.S. macroeconomic data. "High interest rates mean the money would rather stay in the U.S. than trickle to emerging markets like India."

Investors now await domestic GDP data for the December quarter, due later in the day, which is expected to show year-on-year growth slowing to 4.6%.

Among individual stocks, Zee Entertainment rose over 6%, after being reincluded in the derivatives segment, while the flagship Adani Enterprises surged over 14% to emerge as the day's top Nifty 50 gainer.

($1 = 82.7150 Indian rupees)