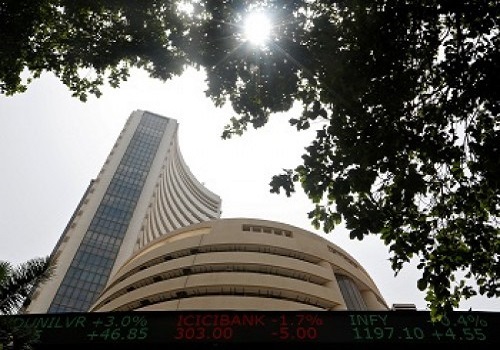

Indian shares log best day in over three weeks in post-selloff jump

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian shares recorded their best day in over three weeks on Monday, led by gains in consumer and automotive stocks, after a sharp two-day selloff at the end of last week on fears of a global recession.

The Nifty 50 index closed 0.83% higher at 18,420.45, and the S&P BSE Sensex rose 0.76% to 61,806.19. Both the benchmarks posted their biggest one-day gain since Nov. 24.

The gains come after the two indexes fell a little more than 2% last Thursday and Friday on mounting fears that the U.S. Federal Reserve's mid-week announcement to keep raising interest rates would tilt the economy into a recession. That sparked a slide in most stock markets globally.

Globally, most stock markets also rose on Monday, with some analysts suggesting India's relatively stronger recovery could be due to traders covering short positions.

"Short-covering helped the local benchmarks stage a smart bounce back," said Shrikant Chouhan, head of equity research (retail) at Kotak Securities Ltd.

Indian stocks, though, have fared better than global peers, including hitting all-time highs at the start of the month, an outperformance that "no doubt" will continue, said Yogesh Nagaonkar, founder and CEO at Rowan Capital Advisors.

Among sectors, IT stocks, which led the benchmarks lower last week, stayed in the red, falling 0.51%, after Accenture Plc's sales warning added to fears over client spending, especially in the key U.S. market.

But the more domestically focused sectors gained on the day. Fast-moving consumer goods and auto stocks rose over 1% to lead the gains.

Nagaonkar said domestic inflation has peaked and that the Reserve Bank of India will be cautious with rate hikes so that they don't stymie economic growth. ($1 = 82.7060 Indian rupees)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">