Indian markets could open flat to mildly higher, following largely negative Asian markets today and mixed US markets on Monday - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets could open flat to mildly higher, following largely negative Asian markets today and mixed US markets on Monday - HDFC Securities

The Dow Jones Industrial Average closed higher, but shy of the 32,000 mark Monday, while the tech-heavy Nasdaq Composite ended sharply lower to enter correction territory — underlining a stock-market rotation being driven by a continued rise U.S.

Treasury yields. Markets are being driven by expectations that aggressive fiscal spending, coupled with a rapidly reopening economy as vaccine rollouts continue, could result in a near-term surge in inflation.

Long-dated bond yields rose on Monday as selling pressure on government debt resumed, pushing the yield on the benchmark 10-year to the highest level in about 13 months. The move came after the Senate over the weekend approved the Biden administration’s $1.9 trillion COVID-19 relief bill, moving the package closer to reality. The 10-year Treasury note yield rose 4.3 basis points to 1.594%, marking its highest yield since Feb. 13, 2020. Gold futures lost 1.2%, to settle at an 11-month low of $1,678, as rising yields took some of the luster from the precious metal.

Asia-Pacific markets have opened little changed Tuesday in a fragile environment. Strengthening US Dollar is creating ripples among the emerging economies. Indian benchmark equity indices ended little changed on Mar 08, reacting from higher levels seen earlier in the day. At close the NSE Nifty 50 index ended with gains of 18 points at 14,956.

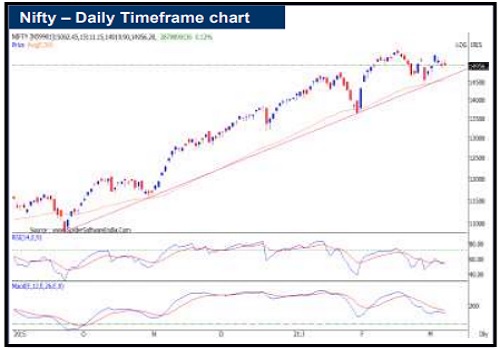

Nifty has started the week on a weak note giving up the early gain mainly due to weak Asian cues later in the day. Nifty is repeatedly facing selling pressure from 15100-15200 band. So far 14862 level has provided support. A breach of this level could take the Nifty to 14637-14725 band.

BPCL launches block deal to raise around Rs 3,700 crore:

Bharat Petroleum Corporation (BPCL), which is one of the key divestment candidates of the government, launched a block deal on March 8 to sell up to 4 percent of its treasury shares worth Rs 3,700 crore. According to the term sheet of the deal, BPCL has set a floor price of Rs 435 per share for the proposed transaction which is at a 7 percent discount to the closing price on March 8, 2021

Daily Technical View on Nifty

Nifty in a Choppy Trend

Nifty ended the sessions with a minor gain of 18 points to close at 14956

Currently Nifty is passing through the choppy trend where taking direction move is difficult

Choppy trend in Nifty is likely to continue unless Nifty breakout from the narrow range of 14700- 15300 Nifty has finding support on its 20 days EMA for last two sessions

At present 20 days EMA is placed at 14908, which can act a immediate support in Nifty Immediate resistance for Nifty is placed at 15273 Below 14600, Nifty would enter in positional down trend.

After open, Smallcap and Midcap indices too closed with red candle.

These both indices are down from 5 th March 2021 high but still not out. Positional up trend is still intact All sectoral indices have entered in consolidation mode for short term.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Markets precariously poised

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions