Indian markets could open flat, despite largely positive Asian markets today and mildly negative US markets on Monday - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets could open flat, despite largely positive Asian markets today and mildly negative US markets on Monday - HDFC Securities

U.S. stocks closed slightly lower Monday, starting a week that will include first-quarter earnings report from some of the largest banks, including JPMorgan Chase & Co. and Goldman Sachs Group Inc. Market participants also weighed inflation risks, a sharp rise in the U.S. deficit and comments from Federal Reserve Chairman Jerome Powell in a “60 Minutes” interview that aired on Sunday.

The U.S. federal budget deficit more than doubled to a record in the first half of the fiscal year amid a fresh wave of stimulus payments to cushion Americans from the persistent coronavirus pandemic. The deficit last month was $659.6 billion, the thirdlargest on record and biggest since last June, swelling the total from October to March to $1.71 trillion, according to a Treasury Department report Monday. The six-month total compares with $743.5 billion in the prior-year period.

In India, the Index of Industrial Production (IIP) showed industrial output in India once again shrank in February, going down by 3.6 percent. IIP had contracted by an updated 0.9 percent in January after rising by 1.6 percent in December. India's industrial output has now shrunk 11.3 percent in the April-February period of FY21, as compared to the same period of the previous year.The latest fall in IIP is mainly attributed to a 3.7 percent fall in manufacturing output, a larger fall than January's 2 percent contraction.

India’s Consumer Price Index-based inflation (CPI) for the month of March came in at 5.52 percent, rising from February's 5.03 percent. The combined food price inflation rose to 4.94 percent in March, as compared to 3.87 percent in February. Shares in Asia-Pacific edged higher in Tuesday morning trade following a muted finish overnight on Wall Street.

U.S. consumer price data for March due to be published Tuesday will be keenly watched as will be the China trade data due to be released in the morning. Indian benchmark equity indices fell sharply by over 3.5 percent on April 12 – the most in a month - as due to rapidly rising covid cases the government of Maharashtra (the richest state) will take a lockdown decision post the state Cabinet meeting on April 14. At close, the Nifty was down 524.10 points or 3.53% at 14310.80.

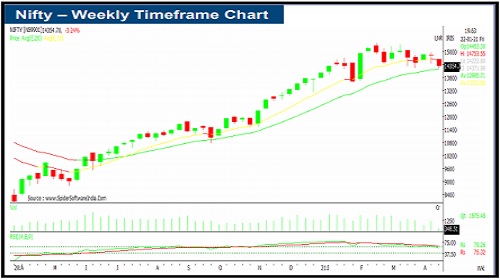

Nifty turned up today from 14249, making a near double bottom with 14264 made on March 25, 2021. A breach of this level could lead to more weakness in the near term. 14460-14574 could be the resistance for the Nifty in the near term. While sentimentally there is little to expect in terms of bounces, some positive news on the Covid or its vaccination front could provide a respite, howsoever temporary.

Daily Technical View on Nifty

Observation: After showing minor weakness from the hurdle of 14900 on Friday, Nifty witnessed bloodbath on Monday and closed the day sharply lower by 524 points. After opening on a downside gap of 190 points, Nifty slipped into further weakness in the early to mid part of the session. An attempt of upside recovery in between was met with selling for the day. Nifty finally closed the day with minor upside recovery note. A long bear candle was formed on the daily chart with minor lower shadow and the opening downside gap remains unfilled.

The Nifty has revisited the crucial lower support of previous opening upside gap area (post union budget-21) and also previous swing lows of around 14260 levels. The quantum of upside recovery from near this support is not convincing. The present chart pattern on the daily chart indicate chances of decisive downside breakout of the crucial lower support and also a broader high low range of the market around 15300-14300 levels.

But, the market has failed to show any follow-through weakness in the last few weeks. Nifty on the weekly chart has moved below the crucial 10 week EMA around 14600 and is now holding on another support of 20 week EMA at 14200 levels. The area of 10 w EMA was retained after intra week violation on the downside in past. Hence, a decisive move below 14200 is likely to open a broad based weakness in the market.

Conclusion: The sharp decline of Monday seems to have reversed the short term positive sentiment within a broader range. From near the upper range of 15200, the market has reached down to the lower range of 14300-14200. Hence, there is a higher possibility of sharp move on either side. If the sustainable buying emerge from here, the Nifty could show upside bounce up to 14800-14900 in the coming weeks. A decisive move below 14200 could drag down to 13700-13600 by this month.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">