India rolls back decision to cut interest rates on small savings

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NEW DELHI - India has reversed its decision to lower interest rates by up to 1.1% on its state-backed small savings scheme, Finance Minister Nirmala Sitharaman said on Thursday, adding that orders to cut rates to a near five-decade low were issued due to an oversight.

Small savings are the lifeblood of India's low and middle income groups, and cutting interest rates would have dealt a severe blow to hundreds of millions of Indians at a time when thousands have lost jobs and faced pay cuts due to the pandemic.

"India shall continue to be at the rates which existed in the last quarter of 2020-2021, i.e., rates that prevailed as of March 2021," Sitharaman said in a tweet on Thursday.

"Orders issued by oversight shall be withdrawn," she said.

A day earlier, on the last day of the 2020/21 financial year, India had cut interest rates on small savings by up to 1.1% for the June quarter. The government reviews interest rates on government-backed schemes every quarter.

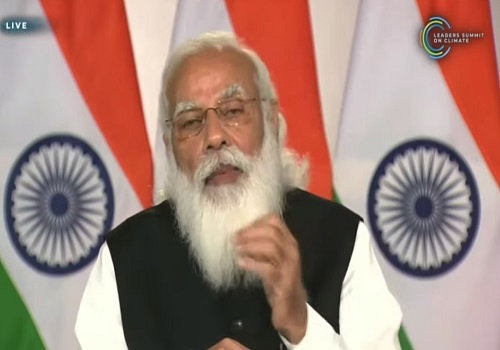

Prime Minister Narendra Modi's federal government has attempted to link state-backed small savings rates with yields on government bonds every 3 months.

However, interest rates have largely been kept above market rates, which experts say is due to fear of a backlash from middle class voters.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings