India outperformed global markets in CY22 till date - Motilal Oswal Financial Services Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

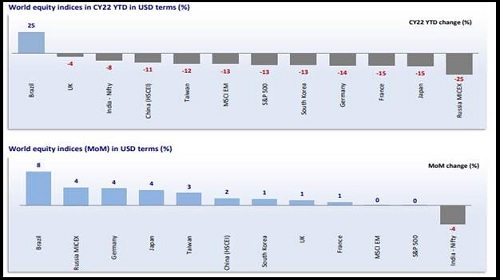

According to the India Strategy - the Eagle Eye Report by Motilal Oswal Financial Services Limited (MOFSL), India outperformed global markets in CY22 till date. Overall, Global Cyclicals were the top losers in May’22 while Autos and Consumer were the only gainers. There was a sharp surge in yields in CY22 till date, as the focus of global central banks shifts towards fighting inflation. 4QFY22 results were in line with BFSI and Commodities driving the earnings. The MOFSL Universe reported sales/EBITDA/PBT/PAT growth of 25%/12%/19%/21% YoY (est. 32%/14%/21%/19%).

Key highlights from the report

About 62% of Nifty constituents decline in May’22:

➢ Among Nifty companies, 19 posted gains in May’22, led by Auto and Consumer stocks. Four out of the top 10 gainers were from the Automobile space (M&M, Hero MotoCorp, Eicher Motors, and Bajaj Auto).

➢ Among Nifty constituents, 46% are trading higher in CY22 YTD. Coal India, NTPC, ITC, M&M, and Bajaj Auto led the gainers pack, with gains of over 15% in CY22 YTD.

About 26% of BSE 200 constituents close higher in May’22:

➢ Around 26% of BSE 200 constituents gained in May’22. Eight companies have gained over 10% in May’22

➢ Around 34% of BSE 200 constituents are trading higher in CY22 YTD, with Adani Power having gained more than 100%

About 74% of BSE 200 constituents decline in May’22:

➢ About 74% of BSE 200 constituents decline in May’22. Adani Green, JSPL, and Adani Transmission dip by more than 25% MoM

➢ Around 66% of BSE 200 companies decline in CY22 YTD, of which 61% have underperformed the index

Average daily cash volumes fell to a five-month low:

➢ Average daily cash volumes decline to INR619b after hitting a six-month high in Apr’22

➢ Non-institutional participation declines to 55% of total cash volumes in May’22

Around 45% of the recently listed companies are trading below their offer prices:

➢ Around 61 companies, out of the 138 new listing in the last one year, are trading below their offer price

➢ Of the companies with an issue size of over INR10b, the top gainers are Adani Wilmar (up 191% from its offer price), Clean Science (+95%), Sona BLW Precision (+91%), Devyani International (+89%), and Ruchi Soya (+68%).

➢ The top laggards are One97 Communications (-70%), CarTrade (-61%), Fino Payments Bank (- 56%), Nuvoco Vistas (-47%).

Midcap and smallcap indices underperform:

➢ Midcap and smallcap indices underperformed the Nifty. Autos, Consumer, and Infrastructure were the relative outperformers, while Realty and Technology were the laggards.

➢ Nifty constituents away from their 52-week highs – 11 companies outperform the benchmark.

Commodity companies decline the least in the current fall:

➢ Nifty 500 constituents that declined the least from their 52-week high.

4QFY22 results review: In line; BFSI and Commodities drive earnings:

➢ The MOFSL Universe reported sales/EBITDA/PBT/PAT growth of 25%/12%/19%/21% YoY (est. 32%/14%/21%/19%).

➢ BFSI, Metals and O&G drive the quarter’s earnings. Excluding these three sectors, PAT growth was modest at 10%, in-line.

The Indian economy grew 8.7% in FY22, up 1.5% from FY20 levels:

➢ Real GDP growth decelerates further to 4.1% YoY in 4QFY22 which implies an 8.7%/19.5% growth in real/nominal GDP in FY22.

➢ GST collections in May’22 totaled INR1.4t, showing consistent resilience.

Nifty composition: O&G leads the gainers pack in CY22 till date:

➢ The weightage of the O&G sector rose 140bp from Dec’21 to 13.7% – the highest since Dec’11 levels.

➢ The weightage of the Technology sector fell 320bp to 15.9% in May’22.

➢ NBFCs + Insurance sectors’ weightage declines by 90bp since Dec’21 to 10.5%.

Relentless FII outflows continue in May’22; DIIs more than match with big inflows:

➢ FII outflows continued for 8th consecutive month. YTD’22 outflows stand at USD 22.2b.

➢ Domestic inflows were the highest since Mar’20 at USD6.1b in May’22. YTD’22 inflows stand at2 USD 20.7b

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Local equities continue to sink in red