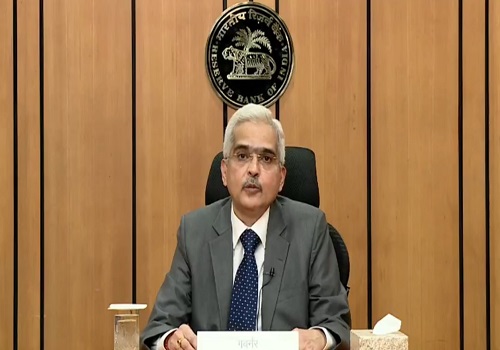

India central bank chief says inflation has moderated, but no room for complacency

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India's inflation has moderated, but the central bank cannot be complacent towards easing price pressures yet as potential weather-related uncertainties linger, the governor of the Reserve Bank of India said on Wednesday.

"The war on inflation is not over; we have to remain alert," Shaktikanta Das said at an event in New Delhi.

"There is no room for complacency. We will have to see how the El Nino factor plays out."

India's annual retail inflation eased to 4.7% in April from 5.66% in the previous month, according to data.

This month's retail inflation data, scheduled to be released on June 12, "could perhaps be lower," Das said.

The RBI targets inflation at 4%, with a tolerance level stretching up to two percentage side on either side.

The rate-setting Monetary Policy Committee has raised the policy repo rate by 250 basis points since May last year to quell inflationary pressures. The panel kept the repo rate steady at its meeting last month and is expected to pause again when it meets in June.

Apart from posing upside risks to inflation, El Nino could also weigh on India’s economic growth, Das said. Geopolitical uncertainties, declining merchandise trade due to a contraction in global trade could also add to downside risks to growth, he said.

In spite of these factors, India's gross domestic product growth could be above 7% for 2022-23, and such an outcome, if realised, should not come as a surprise, the governor said.

India is expected to record a GDP growth of close to 6.5% in 2023-24, he said, adding that capital expenditure is picking up in the private sector, while infrastructure spending by the government is also on the rise.

The RBI will endeavour to stay prudent and act on time to ensure financial stability, remaining proactive in foreign exchange management, and will continue to focus on stability of the rupee, Das said.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">