Index is likely to open on a positive note tracking firm global cues - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: 15556

Technical Outlook

• The index witnessed a roller coaster move as it oscillated by 700 points during the session. As a result, the daily price action formed a bull candle with shadows on either side, indicating elevated buying demand emerging from 61.8% retracement of the recent up move

• Going ahead, we expect the index to resolve higher and gradually head towards 15800 in coming sessions. Subsequently, a decisive close above 15800 along with improving market breadth will confirm end of corrective phase and open the door for extended pullback in coming sessions. Failure to do so would lead the index to undergo consolidation in 15800-15200 range amid stock specific action. On upsides, level of 15800 will be the key monitorable as it is confluence of: a) downward slanting trend line drawn adjoining subsequent highs of June (16794-16493), around 15800 b) 38.2% retracement of June decline (16794-15183) c) lower band of negative gap recorded on June 13 (16201-15878)

• On the downside, immediate support for the Nifty is placed at last week’s low of 15200. Only the breach below 15200 (on a closing basis) would lead to extended correction towards major support zone of 14800-14600 which we expect to hold amid oversold condition as it is confluence of: a) 80% retracement of CY21 rally (13596-18604), at 14600 b) implied target of recent consolidation breakdown 16800- 15700, is placed at 14600

• Structurally, the sentiment indicators are approaching their bearish extremes. Historically, reading of percentage of stock above 200 DMA below 15 signifies extreme pessimism in the markets that eventually leads to a technical pullback in subsequent weeks. Currently index recorded bearish extreme of 12 (which is lowest since March 2020) suggesting possibility of a technical pullback in following weeks

• On the broader market front, in three instances over past decade, maximum bull market correction in the Nifty Midcap, Small cap indices have been to the tune of 28% and 38%, respectively. In current scenario both indices have corrected 25% and 34%, respectively. Thus possibility of 3-4% correction from hereon cannot be ruled out amid oversold territory which would set the stage for a technical pullback in coming weeks

• In the coming session, index is likely to open on a positive note tracking firm global cues. We expect index to trade with a positive bias while forming higher high-low on daily chart. Hence, use intraday dip towards 15514-15542 for creating long position for the target of 15630

NSE Nifty Daily Candlestick Chart

Nifty Bank: 33135

Technical Outlook

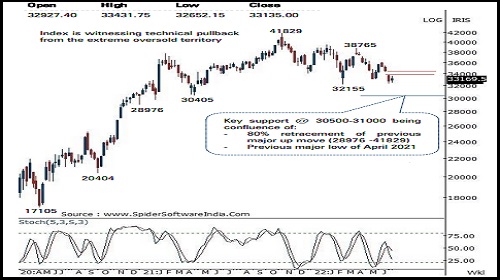

• The daily price action formed a high wave candle with a small real body and long shadows in either direction . The index formed a lower low and a higher high in the daily chart highlighting intraday volatility . The index in the last three sessions is seen consolidating around the 33000 levels .

• Going ahead, index sustaining above Thursday’s low (32652) will signal continuation of the current pullback towards the immediate hurdle of 33800 levels being the confluence of the lower band of the last Monday’s gap down area (33774 -34345 ) and the 38 . 2 % retracement of the last three weeks decline (36083 -32291 ) .

• The Index need to start forming higher high -low in the daily chart on a sustained basis for any meaningful technical pullback to materialize

• The index has major support around 30500 -31000 levels being the confluence of the following technical observations :

• (a) 80 % retracement of the previous major rally of December 2020 -October 2021 (28976 -41829 )

• (b) previous major low of April 2021 is also placed at 30405

• Among the oscillators the daily stochastic has rebounded from the oversold territory and is in up trend thus supports the continuation of the current pullback in the coming sessions

In the coming session, index is likely to open on a positive note tracking firm global cues . We expect the index to hold the psychological mark of 33000 and trade with a positive bias . Hence use intraday dips towards 33060 -33140 for creating long position for the target of 33390 , maintain a stoploss at 32940

Nifty Bank Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct