The index is likely to witness a gap up opening tracking buoyant global cues - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

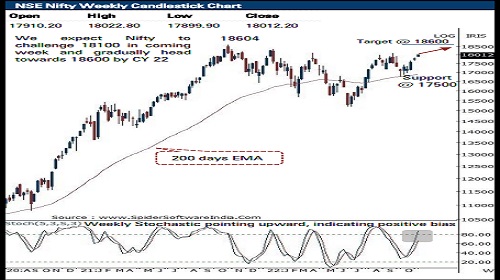

Nifty

The Nifty started the week with a positive gap 17786-17900 and inched northward as intraday dips were short lived during the session. Fag end buying demand helped the index to settle above the psychological mark of 18000. The daily price action formed a bull candle carrying a higher high-low, indicating continuance of positive bias. As a result, Nifty recorded highest ever monthly closing of 18012

We maintain our positive stance and expect the Nifty to challenge the immediate hurdle of 18100 and gradually head towards 18600 by December 2022. Hence, a temporary breather from here on should not be construed as negative. Instead, dips should be used as buying opportunity as we do not expect the key support of 17500 to be breached. Our positive stance is based on following observations:

a) breakout from past 12 months falling trend line confirms conclusion of corrective bias, auguring well for extension of ongoing up move

b) historically, over the past two decades, Q4 returns for the Nifty have been positive (average 11% and minimum 5%) on 15 out of 21 occasions (70%). History favours buying dips from here on

c) Indian equities continued to outperform their global peers, showing inherent strength

d) Dollar index has registered breakdown from four week’s range while US Dollar/INR pair retreated from upper band of long term rising trend line at 83.30. Going ahead, further cool off in Dollar index would provide stability to the rupee against the US dollar and support Indian equities in coming weeks

e) Russell 2000 index has resolved out of four week’s base formation, indicating rejuvenation of upward momentum. We believe Nifty midcap index has undergone strong base formation and expect catch up activity • Structurally, formation of higher high-low on the weekly chart signifies revival in upward momentum that makes us confident to revise support base at 17500 as it is 50% retracement of past three week’s rally 16950- 18022

Broader market indices have rebounded after forming a higher base above 100 days EMA. We expect the Nifty midcap and small cap indices to resolve higher and witness catch up activity against the Nifty amid advancement of earning season

In the coming session, the index is likely to witness a gap up opening tracking buoyant global cues. We expect the index to endure its upward momentum and challenge 18100 mark. Hence, use dips to create intraday long positions in the range 18110-18140 for target of 18227

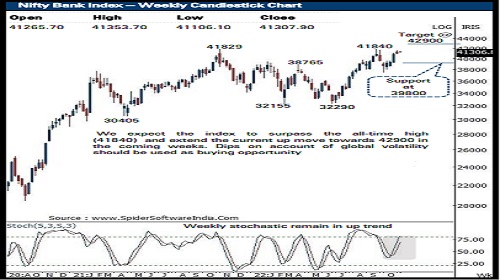

Bank Nifty

The daily price action formed a high wave candle as it remained contained inside previous session high -low range signalling consolidation amid stock specific action ahead of the US Federal Interest rates decision on Wednesday

Going forward, we reiterate our positive stance and expect the index to surpass the all -time high (41840 ) and extend the current up move towards 42900 levels in the coming month being the 123 . 6 % external retracement of the recent breather (41840 -37386 ) . Dips on account of global volatility should not be constructed as negative instead should be used as a buying opportunity

Nifty PSU banking stocks continue to outperform and the PSU bank index has recently posted a resolute breakout above CY21 highs and past five years down trend line indicating strong structural uptrend While large caps have seen strong traction, we expect smaller PSU banks to catch -up and witness strong upward momentum

Structurally, in the Bank Nifty rallies are getting faster and stronger while corrections are shallow, underpinning inherent strength . It has recently generated a faster retracement on higher degree as eight month’s decline (41829 -32990 ) was completely retraced in just two and half months highlighting robust price structure

Amongst momentum oscillators, weekly stochastics remain in uptrend and has recently generated a buy signal thus supports the positive bias in the index

The Bank Nifty has support at 39800 mark being the confluence of the (a) 38 . 2 % retracement of the last four weeks up move (37387 -41530 ) placed at 39850 (b) the 20 days EMA currently placed at 40030 levels In the coming session, index is likely to open gap up amid firm global cues . We expect the index to trade with positive bias while forming higher high -low . Hence after a positive opening use intraday dips towards 41490 -41560 for creating long position for the target of 41830 with a stop loss at 41380

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Daily Derivatives Report By Axis Securities Ltd

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">