Hopes of peace in Ukraine keep euro afloat

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

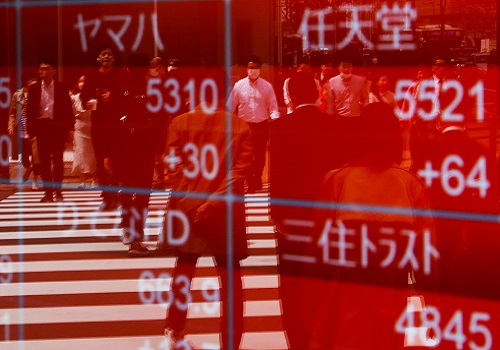

SINGAPORE - The dollar was kept on the back foot on Wednesday as hopes for a breakthrough in Russia-Ukraine peace talks lifted the euro, while the under-pressure yen steadied even as the Bank of Japan redoubled efforts to pin down bond yields.

The euro, battered in recent weeks by fear of the economic fallout from war in Ukraine and nerves about the risk of the conflict spreading west, touched a two-week high of $1.1137 overnight, before settling back to $1.1091 in Asia.

The common currency also jumped through its 200-day moving average on the pound to hit a three-month high of 84.81 pence, while Russia's rouble surged to a one-month top of 83.50 to the dollar.

Russia has promised to scale down military operations around Kyiv and Ukraine proposed adopting a neutral status in a sign of progress at face-to-face negotiations in Istanbul.

U.S. officials poured a little bit of cold water on hopes for a deal by warning the threat to Kyiv isn't over.

"At least the two sides are talking," said Commonwealth Bank of Australia strategist Joe Capurso.

"The tentative good news about the war will benefit the euro more than any other currency given Europe's proximity to the conflict and reliance on Russian energy," he said.

The mood also proved helpful for risk-sensitive currencies such as the Australian and New Zealand dollars. They were firm just below recent peaks in morning trade, with the Aussie at $0.7512 and kiwi at $0.6946. [AUD/]

The South Korean won, which like the euro has been battered by the leap in oil prices since war began just over a month ago, logged its best session in two years overnight.

The yen, meanwhile, is fighting to find a floor around 123 to the dollar.

It is on track for its worst month since November 2016, with a roughly 7% loss on the dollar as Japan's central bank has doubled down on its dovish stance while the rest of the world turns hawkish.

The BOJ, already in the midst of a four-day pledge of unlimited bond buying to hold 10-year yields beneath its 0.25% ceiling, ratcheted up efforts by extending purchases along the curve in both directions.

The 10-year Japanese government bond yield finally fell a bit to 0.225%, though the yen held steady at 122.66 per dollar.

"Risks remain tilted towards the upside for USD/JPY today. The 125.00 mark will continue to be a good level of topside resistance," said Sophia Ng, an analyst at MUFG Bank in Singapore.

========================================================

Currency bid prices at 0054 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar

$1.1096 $1.1086 +0.06% -2.43% +1.1100 +1.1080

Dollar/Yen

122.5650 122.8950 -0.26% +0.00% +123.2000 +122.5800

Euro/Yen

135.99 136.22 -0.17% +4.35% +136.6700 +136.0200

Dollar/Swiss

0.9306 0.9307 +0.03% +2.07% +0.9313 +0.9309

Sterling/Dollar

1.3097 1.3095 +0.01% -3.16% +1.3102 +1.3091

Dollar/Canadian

1.2503 1.2503 +0.03% -1.09% +1.2508 +1.2496

Aussie/Dollar

0.7510 0.7508 +0.04% +3.32% +0.7524 +0.7507

NZ

Dollar/Dollar 0.6944 0.6935 +0.13% +1.45% +0.6948 +0.6933

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

(Reporting by Tom Westbrook. Editing by Sam Holmes.)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">