Holding 16400, Nifty would challenge 16800 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty : 16628

Technical Outlook

• The index witnessed a gap up opening (16352-16528) and traded with a positive bias throughout the week that helped Nifty to approached near our target of 16800, on expected lines. The weekly price action formed a bull candle carrying higher high-low, indicating extended pullback. In the process, India VIX plunged 10% to settle below 20 levels for the week and formed a lower high-low after five weeks, highlighting improvement in sentiment

• Going ahead, Nifty holding 16400 post RBI policy outcome, would challenge 16800 and gradually head towards 17200 in the month of June. Key point to highlight during last week is that, throughout the week index managed to sustain above the earlier range breakout zone of 16400 coincided with positive gap area, highlighting elevated buying demand emerging from immediate support of 16400 as per change of polarity concept. Thus, we believe, after past six sessions rally of 1000 points, a healthy retracement towards 16500-16400 should be used as an incremental buying opportunity with focus on BFSI, IT, Auto and Capital goods

• In large caps, we prefer SBI, HDFC, Coal India, TCS, Tata Motors, ITC, L&T and Titan while in midcaps we prefer Bank of Baroda, Ashok Leyland, Automotive Axles, KPIT Technologies, Concor, Trent, BEL, Elgi Equipments, Zee Entertainment, SRF

• Structurally, the index has formed a higher high-low on the weekly chart after seven weeks corrective phase, indicating pause in downward momentum. The current up move is backed by improving market breadth that bodes well for extension of ongoing up move. The rejuvenating market sentiment makes us confident to retain support base at 16100 as it is 61.8% retracement of current up move (15735-16793)

• Broader market indices extended their pullback and approached upper band of past three weeks range. Going ahead, a decisive close above last week’s high would confirm range breakout that would open the door for extension of pullback in Nifty midcap and small cap indices. Failure to do so would lead to prolongation of range bound activity wherein broader market would undergo a base formation

• In the coming session, index is likely to open on a subdued note tracking muted global cues. We expect index to consolidate amid stock specific action. Hence, use intraday pullback towards 16650- 16682 for creating short position for the target of 16563

NSE Nifty Daily Candlestick Chart

Nifty Bank: 35613

Technical Outlook

• The weekly price action formed a small bear candle as it opened higher, however profit booking at higher levels saw the index gave up its gains and closed marginally lower signaling breather after last two weeks strong up move of 9 % .

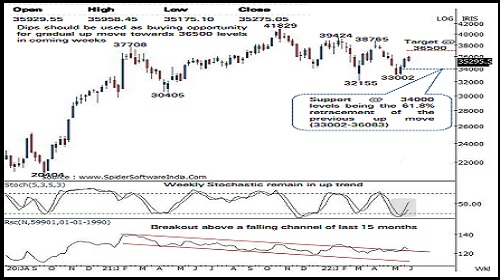

• Going ahead, we expect the index to hold above the support area of 34000 , hence the current breather should not be seen as negative instead dips towards 34000 -34500 should be used as a buying opportunity for gradual up move towards 36500 levels being the 61 . 8 % retracement of the April -May decline (38765 -33002 )

• Key observation in the recent market correction is that Bank Nifty is relatively outperforming the Nifty and the Bank Nifty/Nifty ratio chart has registered a breakout above its last 15 months falling channel highlighting strength and continuation of the current outperformance

• The index has formed a higher high -low on the weekly time frame which make us confident to revise the key support base higher towards 34000 levels as it is the 61 . 8 % retracement of the previous up move (33002 -36083 ) placed at 34100 levels

• Among the oscillators the weekly stochastic remain in uptrend thus supports the overall positive bias in the index in the coming weeks

In the coming session, index is likely to open on a negative note amid weak global cues . We expect it to trade in a range with corrective bias . Hence after a negative opening use intraday pullback towards 35530 -35590 for creating short position for target of 35270 , maintain a stoploss at 35710

Nifty Bank Index – Weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct