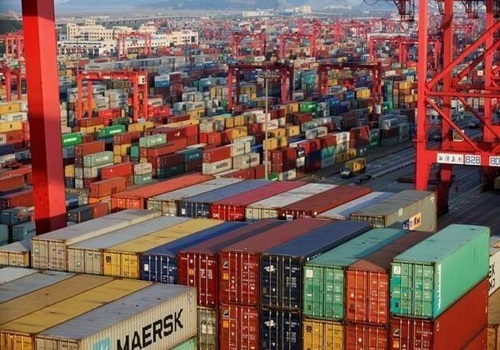

Higher US rates, stronger dollar could lead to acceleration of capital outflows from Asia

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Higher US rates and a stronger dollar could lead to a further acceleration of capital outflows from Asia, Morgan Stanley said in a report.

In managing these pressures, Asian central banks will likely allow their currencies to depreciate while also managing extreme movements and checking volatility rather than hike interest rates, the report said.

In this cycle, the main anchor to central banks' policy reaction is the domestic growth and inflation trajectory. Because there has been less overheating or misallocation and the inflation problem in Asia is more benign than in the rest of the world, we don't expect central banks in the region to tighten deeper into restrictive territory and sacrifice domestic demand in the process. Indeed, we expect Asia's growth differential with the US and other DMs to rise significantly in 2023, assuming China reopens in the spring of 2023, as we anticipate.

The strong dollar environment has raised questions about how Asia will be impacted and whether this will precipitate another financial crisis. "We think this is a very different cycle for Asia - very unlike 1997/98 or 2013", Morgan Stanley said.

The persistence of the strong US dollar environment and the recent sharp run-up in the USD have prompted concerns about the impact on the rest of the world. Specifically for Asia, investors are asking if central banks in the region will have to hike aggressively and disruptively like in 2013 or will this lead to a financial crisis like in 1997/98.

"We believe this cycle is very different for Asia. Unlike in 1997/98 or in 2013, Asia had not levered up excessively prior to the US monetary tightening cycle. There are very limited signs, if at all, of a misallocation of capital or overheating in the region. While there has been a deterioration in macro stability indicators so far this year, we attribute this to the sharp rise in commodity prices earlier in the year, but these effects are expected to reverse soon", it added.

Currencies across Asia are depreciating because of a stronger dollar environment and not because of any existing imbalances related to the Asia macro situation. Indeed, this is best reflected by the fact that trade weighted exchange rates in the region have been relatively stable to appreciating.