H1 FY22 government borrowing calendar on expected lines

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

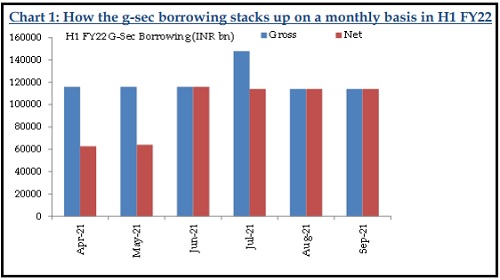

The RBI today released the market borrowing calendar for H1 FY22. As per the calendar, the central government has pegged the H1 FY22 g-sec borrowing at INR 7240 bn (60.1% of the full year budgeted target of INR 12.05 tn) vis-à-vis INR 7060 bn in H1 FY21 (excl. Green shoe option) (59% of the full year borrowing). After taking into account redemptions, the net g-sec borrowing translates to INR 5840 bn in H1 FY22 vis-à-vis INR 5680 bn in H1 FY21.

Key highlights

* Auctions will be spread over 25-weeks, with size ranging between INR 260-320 bn on weekly basis.

* From supply perspective, Apr-21 and May-21 will be the best months as they will see the lowest magnitude of net borrowing at INR 627.3 bn and INR 640.9 bn respectively. The highest supply pressure will be witnessed in Jun-21, with a net borrowing of INR 1160 bn.

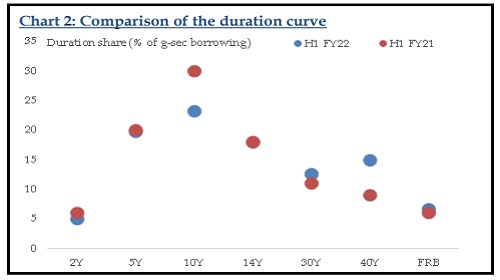

* The belly of the curve (10-14Y segment) will see the highest share of supply at 41.2%. This is moderately lower than the 48.0% share seen in H1 FY21.

* The next highest share of supply is seen by 30-40Y segment at 27.5%, higher than 20% share in H1 FY21.

* The 2-5Y segment sees a slight moderation in supply to 24.7% in H1 FY22 from 26% in H1 FY21.

* The share of Floating Rate Bond (FRB) remains almost unchanged from 6.0% in H1 FY21 to 6.6% in H1 FY22.

Other highlights

* The RBI kept the WMA limit for the central government unchanged at INR 1200 bn for H1 FY22 vis-à-vis H1 FY21.

* The RBI announced Q1 FY21 T-Bill borrowing calendar, as per which the central government would borrow a gross amount of INR 4680 bn via 3M, 6M, and 12M bills.

Our take

Against the backdrop of elevated supply, the market expectations centered around a comparable degree of front loading of bond supply in H1 FY22. The market borrowing calendar is indicative of this with 60% of the full year borrowing scheduled for H1 FY22 vis-à-vis 59% in H1 FY21. The possibility of additional market borrowing and fiscal slippage (FY22 Fiscal Deficit: 6.8%) looks limited as of now on the back of economic recovery gaining momentum, resulting in higher revenue receipts. Though risks of a resurgence in COVID-19 cases remain, the pace of rollout in COVID-19 vaccinations provides some comfort.

Meanwhile, weekly supply pressure in H1 FY21 remains high. However, we expect the bond market to draw some comfort from –

* Large scale OMO purchases likely by the central bank. The OMO operations in FY22 are expected to be above INR 3 tn, similar to FY21 level, as indicated by RBI Governor.

* The possibility of inclusion of Indian G-secs in the global bond indices. Reportedly, FTSE Russell has placed India on the watch-list for a potential future inclusion in its government bond index. In case of inclusion in a global bond index, the supply pressure on banks to invest in G-secs will reduce and FPI investments in G-secs market will improve. As of Dec-20, FPI investment in government debt market remains at a low of 2.1%.

* We expect the 10Y benchmark G-sec yield to trade between 6.10-6.25% in the near term, while approaching 6.50% level by Mar-22. Apart from high bond supply pressure from government borrowing at Centre and State level, we expect the following factors to continue to weigh on the bond market sentiment:

* Increase in discomfort around sticky core price inflation, which is likely to exaggerate further over H2 FY22,

* Increase in global oil prices,

* Possibility of a 25 bps rate hike in Q4 FY22, in case of durable pick-up in growth momentum, and

* Most importantly, global risk aversion backdrop amidst rise in UST yields

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings