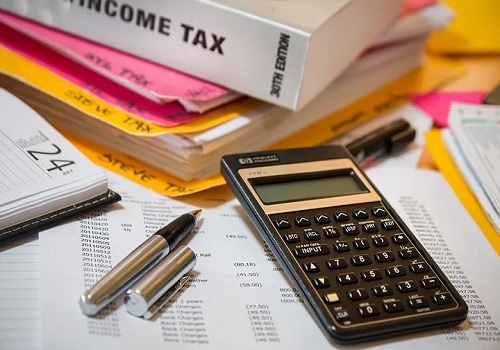

Government extends tax compliance timelines in light of pandemic

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

In view of the severe Covid-19 pandemic raging requests put forward by taxpayers, tax consultants and other stakeholders, the government has decided to provide further relief to taxpayers by extending various time limits of compliances.

Accordingly, the time limit for passing of any order for assessment or reassessment under the Income-tax Act, 1961 has been extended to June 30, 2021. This time limit was earlier extended to April 30, 2021 through various notifications issued under the Taxation and Other Laws (Relaxation) and Amendment of Certain Provisions Act, 2020.

Similarly, the Central Board of Direct Taxes (CBDT) has also extended the time limit for passing an order consequent to direction of DRP under sub-section (13) of section 144C of the Act for three months to June 30, 2021.

The board has also extended the time limit for issuance of notice under section 148 of the Act for reopening the assessment where income has escaped assessment by three months while the same extension has also been given for sending intimation of processing of Equalisation Levy under sub-section (1) of section 168 of the Finance Act 2016.

It has also been decided that time for payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020, without an additional amount, shall be further extended to June 30, 2021.

A finance ministry statement said that notifications to extend the above dates will be be issued in due course.

Top News

India's higher govt borrowing may be offset by lower state debt supply in H2 - ICICI Securities

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings