Gold to move higher towards 50000 mark by Mr. Prathamesh Mallya, Angel Broking Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Quote On Gold to move higher towards 50000 mark by Mr. Prathamesh Mallya, AVP- Research, Non-Agri Commodities and Currencies, Angel Broking Ltd

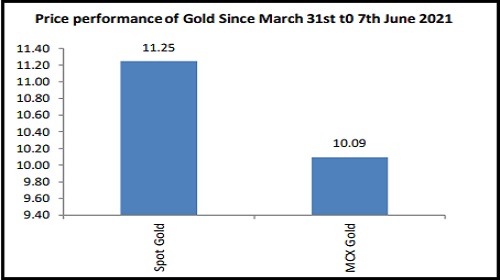

Gold prices have gained 11 percent in the international markets and around 10 percent on the MCX futures in the time period 31st March to 7th June 2021. The factors surrounding the rise in the yellow metal is a combination of host of factors ranging from increased inflationary pressures, weakness in the dollar index, and the White house proposal of $6 trillion to ramp up spending on infrastructure programmed to boost the economy

Investors interest rise in the Yellow Metal

The employment prospects in the US have shown signs of improvement with the recent NonFarm Payroll data that was released on 4th June 2021. Nonfarm payrolls increased by 559,000 jobs last month (May 2021) after rising 278,000 in April. That left employment about 7.6 million jobs below its peak in February 2020. Economists polled by Reuters had forecast 650,000 jobs created in May. About 9.3 million people were classified as unemployed last month. There are a record 8.1 million unfilled jobs.

Moreover, the weakness in the dollar index and its inverse co-relation with the gold has had a fair share in rising gold prices in the past two months. The dollar's index against a basket of six major currencies stood at 90.021 as on 8th June, not far from 89.533, a 4 1/2-month low touched late last month. In the dollar positions as reported by the CFTC, net dollar short positions have been falling over the past weeks in a sign of possible recovery and growth in the US economy.

Inflation rising at a faster pace, What will FED Do?

U.S. consumer prices increased by the most in nearly 12 years in April as booming demand amid a reopening economy pushed against supply constraints, which could add fuel to financial market fears of a lengthy period of higher inflation. The data suggests increasing periods of inflationary trends for the past 6 months. The data for May is due to be released on Thursday 10th June 2021, and is estimated to report a higher number at 4.7% as per Reuters Poll.

Higher inflationary trends is already the talk of the town and the FED might consider to taper its Bond Buying Programme is a discussion in financial circles. We have recently seen Fed press release on 2nd June stating that they are considering winding down the portfolio of Secondary Market Corporate Credit Facility (SMCCF), a temporary emergency facility that closed on 31st December 2020. The SMCCF proved vital in restoring market functioning last year, supporting the availability of credit for large employers and bolstering the employment opportunities during the COVID-19 pandemic.

Where is gold headed?

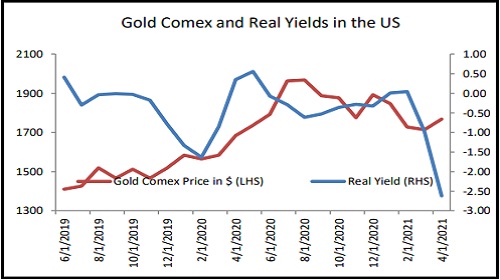

Real yields is nothing but the difference between the 10 year bond yield and the inflation and the curve is in negative trajectory for most of the past months which in turn has lead to rising investment in gold. Till the time the real yields are in a negative territory, the gold prices are projected to remain higher in the months ahead. Although, the inflationary trend seems higher, the unemployment situation in the US as per the recent Non-Farm Payrolls data indicate that the slack in the labor market is going to continue for longer period of time than markets expect. The FED might be on the discussion table to wind up the bond buying purchase programme, but, it will have to consider all the growth indicators before it actually moves towards winding up of QE.

We expect MCX gold futures (CMP: As on 8th June2021:Rs.49056/10gms) prices to move higher towards Rs.50400/10 gms mark in a month time frame while Gold prices on the comex ($1890/oz) to move higher towards $1960/oz in the same time frame.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Clearing the Haze: Northwest China Implements Bold Measures to Combat Rising Pollution by Am...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">