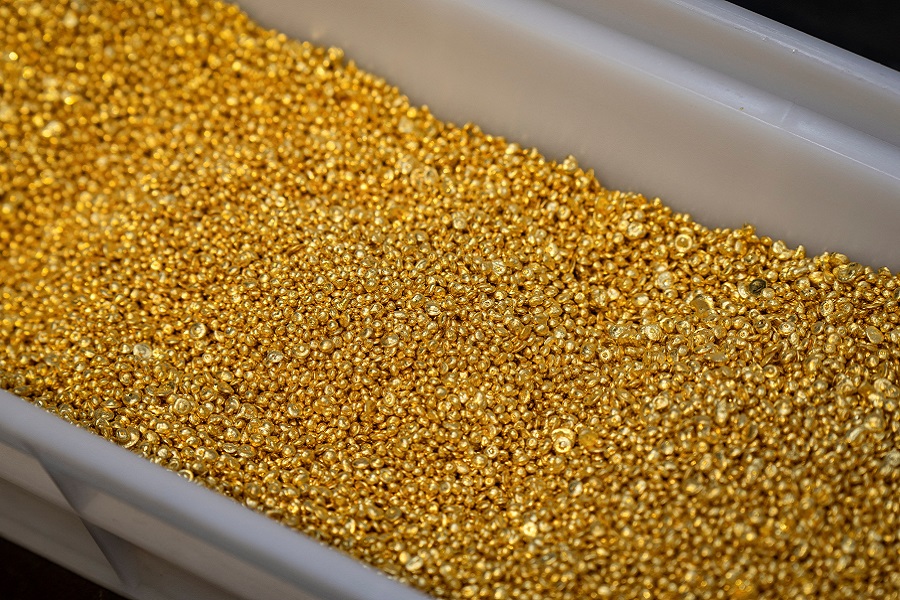

Gold eases on firm dollar as U.S. inflation test looms

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Gold prices inched lower as the dollar firmed on Monday, a day ahead of key U.S. inflation data that could steer the Federal Reserve's rate hike strategy.

Spot gold was down 0.4% at $1,857.90 per ounce as of 1026 GMT. U.S. gold futures inched 0.4% lower to $1,866.60.

The dollar index was up 0.1%. A stronger U.S. currency makes dollar-priced bullion more expensive for overseas buyers. [USD/]

Benchmark 10-year Treasury yields hit their highest level since early January. [US/]

"Gold appears reluctant to make a massive move as the critical U.S. inflation data looms," said Han Tan, chief market analyst at Exinity.

"Fresh evidence that inflation remains stubbornly elevated should prompt bullion to further unwind its year-to-date gains," but if inflation moderates sooner, it will allow the Fed to pause rate hikes and there will be a greater chance of gold climbing to $2,000, Tan said.

U.S. consumer price index (CPI) is expected to have climbed 0.4% in January. Revisions to the previous data set showed consumer prices rose in December instead of falling as previously estimated. The report is due on Tuesday.

While gold is traditionally considered a hedge against inflation, elevated interest rates to tame the rising prices translate to a higher opportunity cost of holding the non-yielding bullion.

Money markets now expect U.S. central bank's target rate to peak at 5.188% in July.

Spot silver fell 0.6% to $21.85 per ounce.

"The fundamental outlook for silver remains very strong with the metal in strong demand from the industrial sector and supply unable to keep pace," Kinesis Money analyst Rupert Rowling said in a note.

"Yet, for now, that fundamental case has not been heard, with macroeconomic factors dominating trading sentiment instead."

Platinum edged 0.5% lower to $939.59, while palladium was flat at $1,542.88.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">