Gold set to end volatile 2020 with strong gains; silver outperforms

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

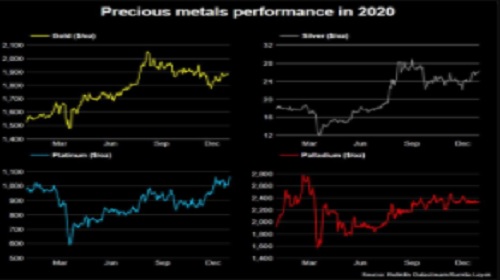

Gold steadied as the dollar extended losses on Thursday, with the metal on track for its best year in a decade on economic uncertainty and as governments worldwide doled out massive stimulus to lessen the impact of the COVID-19 pandemic. Spot gold was trading around $1,892.97 per ounce by 1:53 p.m. EST (1853 GMT). U.S. gold futures settled up 0.1%, at $1,895.10.

Bullion has gained 25% so far in 2020 as global central banks and governments have delivered economic stimulus, laying the ground for higher inflation and currency debasement.

The U.S. Federal Reserve will remain extraordinarily accommodative through 2022 and an increasingly progressive Democratic Party is looking to borrow and spend aggressively, said Tai Wong, head of base and precious metals derivatives trading at BMO.

"Based on that, the U.S. dollar has been slumping badly and can't manage any rally, which is bullish gold," he said. "However, if the vaccine really is effective and we have the pandemic beat by summer, that may limit gold gains."

The non-yielding metal is regarded as a hedge against the inflation that is likely to result from record fiscal stimulus and ultra-dovish monetary policies.

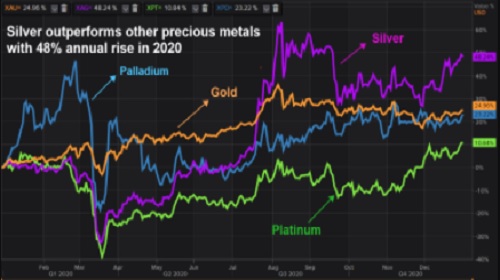

Graphic: Silver outperforms other precious metals in 2020:

Outperforming gold this year with a nearly 48% gain, its strongest performance since 2010, spot silver was, however, down 1.2% at $26.30 an ounce on Thursday. "We forecast further silver outperformance in 2021 on the basis of additional tailwinds from the green transformation driving increased industrial demand, together with the expected economic recovery benefiting silver more than gold," said Saxo Bank analyst Ole Hansen.

Palladium looked set to post gains for a fifth consecutive year, having risen over 25% in 2020, while platinum is on track to record a second straight yearly rise, climbing about 10%.

Palladium jumped 3% to $2,433.61 and platinum eased 0.2% to $1,063.52.

Both the metals are used by automakers in catalytic converter manufacturing to clean car exhaust fumes. With consumers opting for single-family vehicles over public transport, platinum group metals will benefit from a recovery in global auto sales, tightening emission standards, and strong Chinese imports, said Axi chief global market strategist Stephen Innes.

Graphic: Precious Metals performance in 2020:

(Reporting by Asha Sistla, Sumita Layek and Swati Verma in Bengaluru; Editing by Jan Harvey, Barbara Lewis and Jonathan Oatis)

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">