Gold prices expected to surge to Rs.65000-67000/10 gm in long-term : Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Gold prices expected to surge to Rs.65000-67000/10 gm in long-term : Motilal Oswal

November 11, 2020: As per a report –

Gold’s performance and influencing factors:-

Gold in this year has touched an all-time high on both COMEX as well as on domestic bourses. The yellow metal consolidated after touching an all-time high of ~$2085 and ~Rs.56,400, with the overall uncertainties providing a strong floor at lower levels. A massive 40% return in just half year supported by strong fundamentals gives a boost to the metal is a very attractive scenario for the metal. Prices gained at the start of the year as investors worried about the impact of trade war between US and China, Central banks accommodative stance & stimulus measures, excess liquidity, Covid-19 relief bill, lower bond yields, but now Impact of the pandemic and updates regarding the US Presidential election in the recent past has forced market participants to take a cautious approach. All these factors along with volatility in rupee have impacted the domestic prices.

US Presidential election impact

US Presidential election has kept everyone on their feet, and as per the latest outcome, Joe Biden has been declared as the next leader of the USA, bringing some positivity in the overall sentiment. The polls were very supportive for Biden from the start although increase in seats for President Trump during the counting did increase some anxiety in the market. Even though what is believed to be an partial government for Joe Biden, it will be important to see what will be his stance w.r.t combating against the pandemic and supporting the economy. In our previous report ‘How Precious is US election?’, we had mentioned that in the long run whoever wins, it will be beneficial for precious metals as, the above mentioned factors will continue to be in play and support bullions and we continue to stick to this fact as the spill over effect of the excess liquidity, lower interest rates, increased debt etc. could increase the bets for safe haven buying in the long run.

Central bank policies and Demand, Supply scenario for gold

Central banks cut interest rates and provided liquidity in the market to support the ailing economy. Global interest rates are currently near zero level and are expected to remain low for some time. Fed Chairman in his past policy statement has mentioned that it might not go into negative territory w.r.t. interest rates, but keep these low levels till 2023. According to WGC, India's gold demand in the fourth quarter is expected to recover after falling 30% in the previous quarter as festivals are expected to strengthen retail jewellery purchases. They expect Q4 would be better than Q3 due to pent-up demand and festivals.

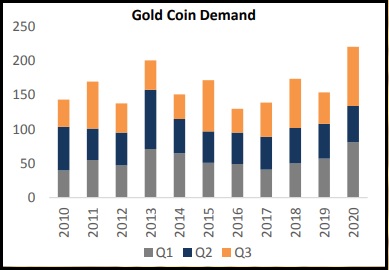

Demand for the precious metal usually spikes towards the end of the year in India, as buying gold for weddings and major festivals such as Diwali and Dussehra is considered auspicious. As much we see an improvement in the overall sales and demand, situation is not improving and the uncertainties hovering around the world has dented the physical gold market to some extent. There are two scenarios here, impact of the pandemic and the lockdown situation is affecting the physical demand and on the other hand higher prices have forced investors to take some time before they start to accumulate, hence demand during fourth quarter could be lower than the 194.3 tonnes recorded last year as consumers are struggling to adjust to near record high prices. India's gold demand in the first three quarters fell 49% from a year earlier to 252.4 tonnes as coronavirus-triggered lockdowns hit jewellery demand. While overall gold consumption fell, demand for coins and bars, known as investment demand, jumped 51% in the third quarter as rising prices attracted investor, keeping the sentiment high.

Gold’s performance in Diwali season

Normally, investors buy gold as a hedge against inflation and uncertainty, although Indians have another purpose of investing in gold, which protects their purchasing power against the depreciation of Rupee over longer periods. Over the last decade gold in India has given a return of 159%. When compared to the equities Dow Jones has given around 154% and the domestic equity index Nifty 50 has given 93% returns in the same period, which makes gold a star performer and particularly justifying the objective of protecting against inflation and depreciating rupee for Indian investors. Gold has performed very well till now on YoY basis, as seen in the adjoining chart. Except for the small dips in between, gold prices has not disappointed investors.

Outlook

A significant price rally is witnessed this year triggered by the uncertainties hovering in the market, impact of the pandemic and also a depreciating rupee. Coming few months after the US Presidential election will be very important to define gold’s short to medium term trajectory, we see a lot of ground to be covered by gold, if macro-economic situation as explained above plays out, which means central banks stance, low interest rates and yields, spill over effect of excess liquidity in the market, impact of pandemic and other concerns could set a perfect picture for a gold rally in the long term. The pace of the rally could depend on the updates on US Presidential election, Covid relief bill, development in the pandemic numbers and its vaccine and few other factors although sentiments does look positive for this Diwali too, keeping the hopes high for bullions.

In the short term, Comex Gold could be forming a base around $1,880 – 1840, while rallies are likely to be capped in the range of $1940 - $1975. Similarity on the domestic front we advise to start accumulating the metal with every dip towards Rs.49, 500-48,500, which is a good range to buy with short term upsides being capped around Rs.52000 - 53,000. On the longer term prices front, we continue to maintain our target of $2500 on the Comex and Rs.65000-67000 on domestic front.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">