Gold prices eased off their nine-month peak on profit taking as equities pared some losses - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

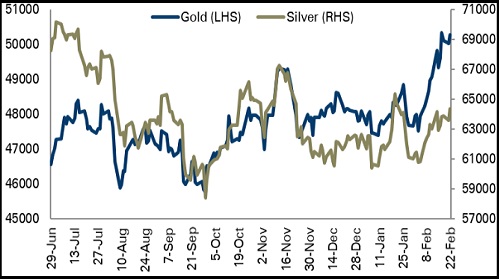

Bullion Outlook

Gold prices eased off their nine-month peak on profit taking as equities pared some losses. Also, prices slipped on surge in US treasury yields, improved economic data from US. Yields bounced back from their low as investors geared up for interest rate hikes

However, further decline was cushioned as geopolitical uncertainty drove safe haven demand. Russian President Putin sent troops into two breakaway areas of Ukraine escalating tensions and raising fears of invasion. US fears Russia is seeking excuse to launch an all-out assault on its neighbour

Gold is likely to trade with a positive bias amid escalating tension between Moscow and West over Ukraine. US and European allies are set to announce sanctions against Russia after Moscow recognised two breakaway regions in eastern Ukraine and ordered deployment of troops there. Investors fear that breakout of war could disrupt commodities supplies adding to inflationary pressures

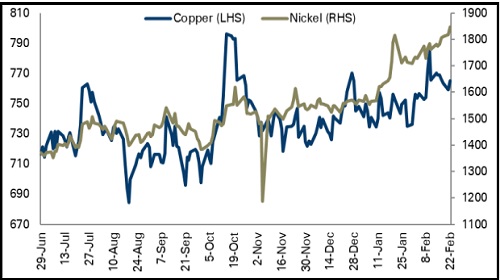

Base Metal Outlook

Copper prices bounced back from their low amid enhanced economic data from US. US Manufacturing and Services PMI data showed activity in both sectors improved. Even consumer confidence index data beat the expectations. However, sharp upside was capped on risk aversion in the global markets

Nickel and aluminium prices hit multi-year highs on worries that sanctions on Moscow could interrupt exports. US and EU allies are set to announce sanctions against Russia to punish for recognising two breakaway regions in eastern Ukraine and ordering deployment of troops there

Copper is expected to trade with a negative bias for the day amid risk aversion in the global market. Market sentiments are hurt on prospect of harsh sanctions against Russia over its conflict with Ukraine and investors fear that elevated crude oil prices will add to inflationary pressure forcing US Fed to consider raising rates at faster pace

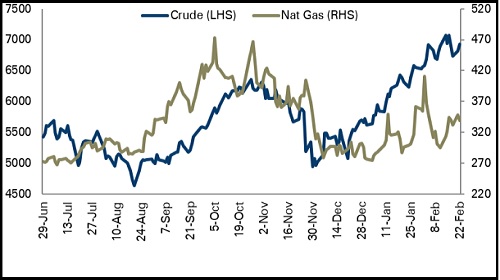

Energy Outlook

Crude oil prices rallied as tensions between Russia and West increased after Moscow ordered troops into two breakaway regions in eastern Ukraine, leading to supply concerns

Furthermore, oil prices rallied after US and EU discussed potential sanctions on Russia. EU proposed a ban on buying Russian bonds and sanctions on three Russian banks. UK sanctioned five banks and three high net worth individuals. Germany suspended the certification of Nord Stream 2 gas pipeline

However, further upside was capped on optimism that reviving Iran’s nuclear agreement will bring more oil into the market

Crude oil is expected to trade with a positive bias for the day amid escalating tension between Russia and Ukraine. Investors fear that outbreak of war will disrupt supply. Ukraine crisis will provide further support to an oil market that has rallied on tight supplies and recovery in demand from pandemic. Meanwhile, market will keep an eye on talks between Iran and world power over nuclear agreement

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer