Gold gains momentum as CRYPTOS fall by Mr. Prathamesh Mallya, Angel Broking Ltd

Below are Quote On Gold gains momentum as CRYPTOS fall by Mr. Prathamesh Mallya, AVP- Research, Non-Agri Commodities and Currencies, Angel Broking Ltd

Gold gains momentum as CRYPTOS fall

Gold prices in the international markets have gained by around 11 percent while on the MCX futures it has gained by around 10 percent in the time period 8th March 2021-19th May 2021.

Host of factors were at play in the past few weeks ranging from weakness in the dollar index, falling bond yields in the US,rising COVID-19 cases in Asia, fall in the value of CRYPTOCURRENCIES and the continuing easy money policies of central banks globally.

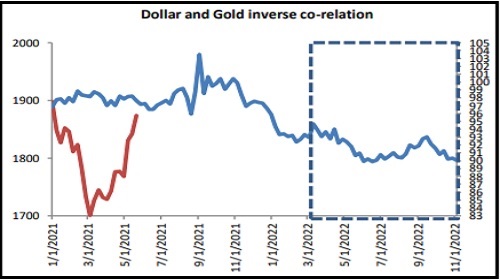

Dollar index and gold share inverse corelation and the fall in the value of dollar in the recent weeks have had a fair share of optimism in gold prices.

The dollar hovered around (89 mark) its lowest levels of the year against major currencies on Wednesday 19th May 2021 as China's tough stance on crypto-currencies sent Bitcoin and Ether tumbling down.

Crypto-currencies retreated sharply after China banned its financial institutions and payment companies from providing services related to crypto-currency transactions, and warned investors against speculative crypto trading. Chinese financial institutions will not be able to offer Crypto-currency registration, trading, clearing, and settlement, in a blow to investors who were betting that digital assets will gain mainstream status.

FED minutes talks about adjusting the pace of asset purchases

Fed officials have pledged to keep their ultra-loose, crisis-fighting policies in place, betting that the unexpected surge in consumer prices last month stems from temporary forces that will ease on their own, and that the U.S. jobs market needs far more time to get people back to work. Also, Coronavirus case and death rates have been falling nationwide, though some concern remains that, with about 40% of adults still yet to receive a vaccination, the risk of COVID-19 will persist

However, Fed minutes of the April (27-28 Meeting) published on Wednesday showed "a number" of officials thought that if the recovery holds up, it might be appropriate to "begin discussing a plan for adjusting the pace of asset purchases".

Where is gold headed?

Weak dollar, fear of inflation and the increasing COVID cases in Asia are turning the heat on gold prices as gold prices maintain their momentum higher. We are not over with the pandemic yet, most of the global world is in a second and third wave of the virus which makes growth look hazy and the central banks promise to do whatever it takes to bring back normalcy in the economy are push factors for gold prices to rise.

We see gold prices to move higher towards Rs.51000/10 gms mark in a month perspective and 46000-47000 zones stand good for accumulation with a stop loss of Rs.44000 per 10 gms.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer