Gold edges higher as traders eye U.S. inflation data, Fed rate decision

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Gold prices edged up on Tuesday helped by a softer dollar, although prices moved in a tight range as investors maintained caution ahead of U.S. inflation data and the Federal Reserve's policy decision.

Spot gold gained 0.3% to $1,785.78 per ounce, as of 0302 GMT. U.S. gold futures were up 0.3% at $1,796.50.

The dollar index was down 0.2%. A weaker dollar makes bullion more appealing to buyers holding other currencies.

Focus now shifts to the U.S. consumer price index (CPI) data for November due at 1330 GMT.

"Market watchers will be digesting the CPI data to gauge whether a hawkish recalibration of rate expectations is warranted ahead of the FOMC meeting," said IG Market strategist Yeap Jun Rong.

"Gold bulls may also attempt to tap on the disinflation narrative for a move higher."

The U.S. central bank is widely expected to hike interest rates by 50 basis points (bps) at its final meeting of this year scheduled on Dec. 13-14.

"The Fed is expected to slow the pace of interest rate hikes, although officials have said they are likely to remain restrictive for some time. A weak inflation print could see that period become shorter than expected," ANZ said in a note.

Lower rates tend to be beneficial for bullion as it decreases the opportunity cost of holding the non-yielding asset.

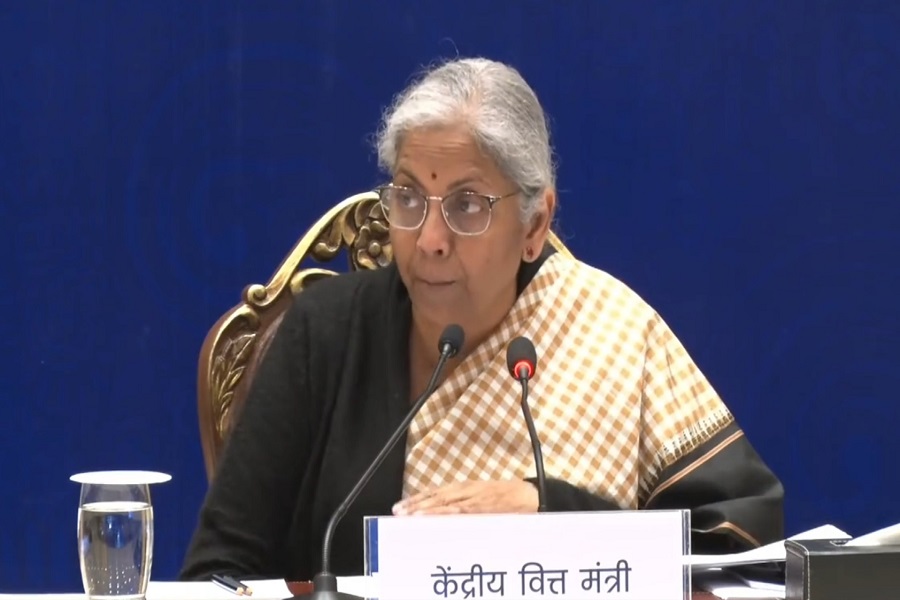

Seizures of smuggled gold in India reached a three-year high this year after the government raised the import duty on the precious metal and international flights resumed following COVID-19 curbs.

Goldman Sachs expects gold, with its real demand drivers, to outperform the highly volatile bitcoin in the long term, the bank wrote in a Monday research note.

Spot silver rose 0.6% to $23.44, platinum was up 0.4% to $1,005.88 and palladium ticked 0.1% higher to $1,889.50.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">