Gold edged lower on Monday, as the dollar steadied near a 20- year peak continuing to weigh on demand for greenback-priced bullion - Nirmal Bang

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Review

US:

Wall Street ended the day flat on Friday as Treasury yields jumped following a stronger-than-expected U.S. jobs report, which suggested the Federal Reserve may push further interest rate hikes to cool the economy and slow inflation.

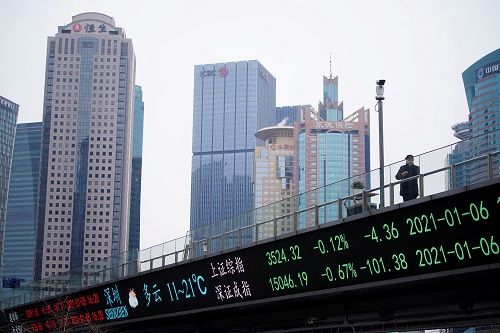

Asia:

Asian shares were mostly under water on Monday as investors braced for a U.S. inflation report that could force another super-sized hike in interest rates, and the start of an earnings season in which profits could be under pressure

India:

Benchmark indices exhibited range-bound trade on Friday as lack of fresh triggers kept indices directionless. The S&P BSE Sensex remained within a narrow range of 348 points, while the Nifty50 travelled 118 points during the day. Market is expected to open gap down and likely to witness profit booking during the day.

Global Economy:

The U.S. economy continued to create jobs at an impressive clip in June, making it easier for the Federal Reserve to carry on with a series of aggressive raises in interest rates. Nonfarm employment rose by 372,000 through the middle of last month, only a marginal slowdown from a revised 384,000 in May and well above analysts' forecasts for a gain of 268,000. Average hourly earnings also stayed strong, growing 0.3% on the month and 5.1% on the year, a little ahead of expectations.

Japan's core machinery orders slipped for the first time in three months in May, hurting hopes that a pickup in business spending would offset pressure on an economy struggling with surging costs of energy and other imports due to a weak yen. Core orders a highly volatile data series regarded as an indicator of capital spending in the coming six to nine months lost 5.6% in May from the previous month, posting their first drop in three months.

Commodities:

: Oil prices were unsteady on Monday, with Brent trading higher on supply concerns while West Texas Intermediate (WTI) dipped, as traders balanced supply concerns against worries about a recession or China's COVID-19 curbs hitting demand.

Gold edged lower on Monday, as the dollar steadied near a 20- year peak continuing to weigh on demand for greenback-priced bullion

Currency:

The dollar was on the front foot at the start of a week in which U.S. and Chinese data and European energy security were top of mind, as investor concerns about global economic growth offered support to the safe haven currency.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH000001766

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...