Gold, Silver, Crude Oil, Natural Gas, Copper, Nickel, Zinc, Lead, Aluminium Commodity Report of 08 April 2021 By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BULLION

GOLD

While there prevails positive bias, 46500 may act as an immediate, but relatively good resistance that has to be breached convincingly for continuation of upswing. Else, corrective dips are likely.

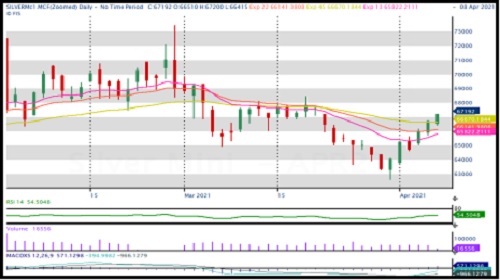

SILVER

Ensuing buying sentiments more likely to continue in the coming session, yet it has to clear the resistance 67200 convincingly to strengthen the positive bias.

ENERGY

CRUDEOIL

Consolidation inside 4540-4200 ranges continues and a voluminous breakout from either the sides could lend fresh directions.

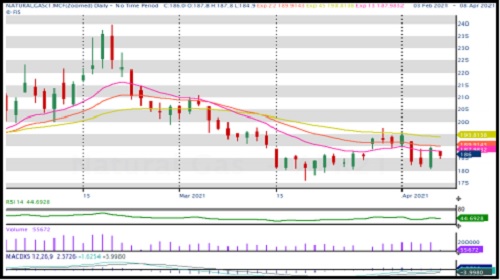

NATURAL GAS

Intraday buying may emerge only on sustained trades over 189 region, and as long as this range caps, may trade sideways with a mild weak bias.

BASE METALS

Copper

Sentiments stays positive and could stretch gains. However, such moves may find resistance near 697. Inability to clear the same may call for profit booking.

NICKEL

Even as there prevails positive bias, 1290 may act as a good resistance and a voluminous rise above the same could strengthen buying. Inability to clear the same may call for profit booking.

BASE METALS

Zinc

Even as there prevails positive bias, corrective dips likely if unable to clear 232.50.

Lead

As long as support at 164 holds, may trade sideways to positive. A direct fall below the same may see weakness creeping in.

BASE METALS

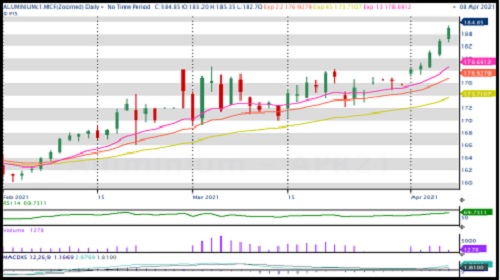

Aluminium

May stretch prices gains as long as support at 181.50 is held downside. Corrective moves stretching beyond the same may lessen the prevailing positive bias.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">