Expiry Express - Bank Nifty opened flattish but failed to hold 31250 zones By Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

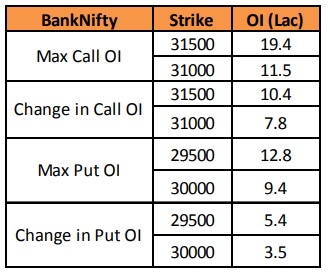

BANK NIFTY : 30284

Bank Nifty opened flattish but failed to hold 31250 zones and it tumbled sharply below 30200 levels by breaking its 50 DMA in the latter part of the day. Selling pressure was seen across all the banking stocks and the index closed with losses of around 900 points. It formed a Bearish candle on daily scale and has been making lower top - lower bottom from the last three sessions. Now till it remains below 31000 zones, bounce could be sold for the down side move towards 30000 and 29500 zones while on the upside hurdles are seen at 31250 and 31500 zones.

Expiry day point of view:

Overall trend is likely to remain negative with sell on bounce strategy till it holds below 31000 zones Now till it holds below 31000 zones bounce could be sold for further downside towards 30000 then 29500 zones. Option traders are suggested to trade with nearby 30200 and 30100 Put and Bear Put Spread.

Trading Range: Expected wider trading range : 29500 to 31000 zones

Option Writing : Aggressive Option writers can sell 30800 Call and avoid Put writing due to higher VIX levels ahead of Budget event

Weekly & Monthly Change : Bank Nifty is down by 3.13% in this series at 30284 on expiry to expiry basis as Dec 2020 series settled at 31264. Bank Nifty is trading 1700 points lower from its Series VWAP of 32000 and 800 points lower from its Weekly VWAP of 31100 levels which suggests bearish bias and selling on bounces.

Key Data

Option Weekly Activity

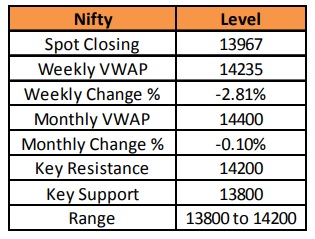

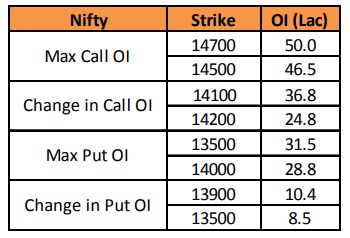

NIFTY : 13967

Nifty index opened gap down and selling pressure dragged the index below psychological 14000 zones. Index slipped and touched intraday low of 13929 levels and closed with losses of around 270 points. It continues its formation of lower top - lower bottom from the last three sessions. It formed a Bearish belt hold sort of candle indicating bears had complete control over the market. Index may continue to remain highly volatile ahead of Monthly expiry and Union Budget 2021. Now, till it remains below 14200 zones, bounce could be sold and weakness may be seen towards 13800 levels while on the upside key hurdle exists at 14200 and 14350 levels

Expiry day point of view: Now till it remains below 14200 zones further weakness could be seen towards 13800 zones Option traders are suggested to be with negative bias till it holds below 14100/14200 levels. One can Buy nearby Put like 13950, 13900 and Bear Put Spread

Trading Range : Expected wider trading range : 13800 to 14100-14200 zones

Option Writing : Aggressive Option writers can sell 14200 Call and avoid Put selling due to higher VIX levels ahead of

Budget Weekly & Monthly Change : Nifty index is marginally down by 0.10% in this series at 13967 on expiry to expiry basis as Dec series settled at 13981. Nifty VWAP of this series is near to 14400 and Index is trading 425 points down from VWAP levels while it down by 270 points from its weekly VWAP of 14235 levels which suggests bearish bias.

Key Data

Option Weekly Activity

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Opening Bell - Markets likely to open in red on ahead of monthly F&O expiry