Evening Roundup : A Daily Report on Bullion, Energy & Base Metals for 25 October2022 By Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

BULLION

GOLD

Range bound movement expected in the counter for the intraday. Any firm move above 50460 region may strengthen the prices. Meanwhile, a dip below 49980 can induce weakness as well.

SILVER

Extending dip below 57000 region may induce further weakness in the counter. Meanwhile, holding the same support may call for mild rebounds as well.

CRUDEOIL

Intraday weakness is expected to continue if trades sustain below 6900 region. Meanwhile, a voluminous rise above 7100 may strengthen the prices, negating bearish expectations.

NATURAL GAS

Bearish crossover in MACD lines suggest the possibility of further weakness in the counter. However, prices need to break below 423 region to extend the fall. Else, mild rebounds may be witnessed.

COPPER

Prices may trade higher as long as the trades sustain above the support of 645. However, a corrective dip below that level could eventually cause prices to decline

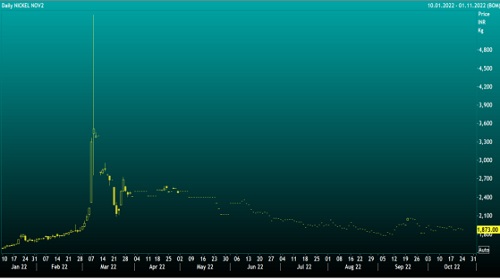

NICKEL

Prices possibly to consolidate with marginal trades.

ZINC

Intraday movement expected to be south bound. However, an unexpected rise above 276 region may strengthen the prices.

LEAD

Priced expected to trade within the range of 175-180 region in the intraday. Move beyond any of these level may fix intraday direction.

ALUMINIUM

Intraday weakness may continue towards 191 or even lower. Even in this weak bias, recovery trades above 197 could lift prices higher.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">