Equity benchmarks concluded weekly derivative expiry session on a positive note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Technical Outlook

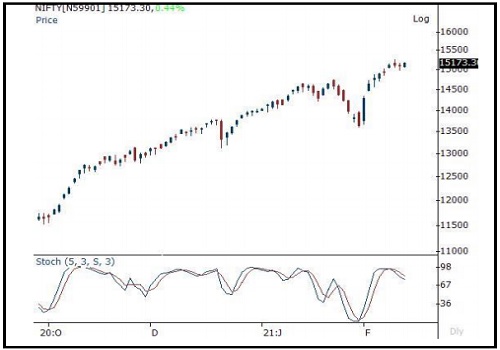

Equity benchmarks concluded weekly derivative expiry session on a positive note. The Nifty settled at 15173, up 67 points or 0.4%. In the coming session, we expect index to witness follow through strength and maintain a higher high-low formation, which would confirm the continuation of upward momentum.

Hence, use intraday dip towards 15090-15114 to create fresh long position for target of 15198. On expected line, index has undergone couple of days breather after 12% rally that helped index to cool off the overbought condition and make market healthy. Key point to highlight is that, despite ongoing breather, Nifty has managed to hold the psychological mark of 15000, indicating inherent strength.

The resilience in key index heavy weight stocks from telecom, banking and auto space makes us confident to believe that index would resolve higher and gradually head towards our earmarked target of 15500 in coming month as it is 161.8% external retracement of past two week’s fall (14754-13596), at 15466.

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct