Equity benchmarks concluded volatile session on a negative note as Crude Oil surpassing 2018 highs - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

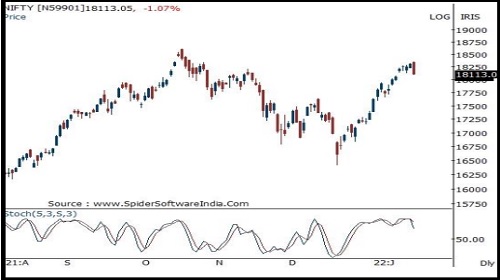

Technical Outlook

Equity benchmarks concluded volatile session on a negative note as Crude Oil surpassing 2018 highs ($87) led to profit booking in domestic bourses. The Nifty Settled Tuesday’s session at 18113, down 195 points or 1.1%. In the coming session, the index is likely to open on a flat note amid muted global cues. We expect volatility to remain high owing to volatile global cues. The index is likely to witness range bound activity while sustaining above psychological mark of 18000. Hence use intraday dip towards 18052-18078 for creating long position for target of 18167

Going ahead, we expect the index to undergo healthy retracement after ~1000 points rally seen during CY22 that hauled daily stochastic oscillator in overbought territory (which was placed at 96 in last session). We believe, ongoing breather amid stock specific action would make market healthy and pave the way for next leg of up move toward life time high of 18600. In the process, we do not expect Nifty to breach the key support threshold of 17800. Therefore, dips should be capitalized as an incremental buying opportunity

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct