Equity benchmarks concluded the weekly derivative expiry session on a subdued note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

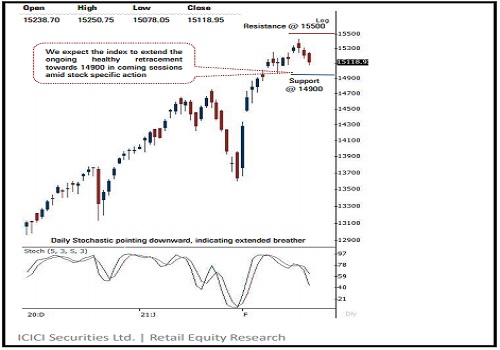

NSE (Nifty): 15119

Technical Outlook

* Equity benchmarks concluded the weekly derivative expiry session on a subdued note. The Nifty ended the session at 15119, down 90 points or 0.6%. However, the market breadth turned positive with A/D ratio of 1.25:1 as broader market outperformed. The Nifty midcap and small cap rose 0.5% and 1%, respectively. Sectorally, IT, metal and PSU banks outshone while auto and private banks underperformed.

* The daily price action formed a bear candle carrying a lower high-low, indicating extended profit booking over a third consecutive session

* Going ahead, we expect the index to extend the ongoing healthy retracement towards 14900 in coming sessions amid stock specific action, wherein midcap and small caps would continue to relatively outperform. We believe the ongoing breather after a sharp post Budget rally of 13% would help the index cool off the extreme overbought conditions of weekly stochastic oscillator (currently at 90) and form a higher base. Meanwhile, upside will be capped at 15500 as it is 161.8% external retracement of the last fall (14754-13596), at 15466

* In line with our view, relative outperformance of broader markets endured despite extended profit booking in the benchmark, highlighting inherent strength. In the process, Nifty midcap index scaled a fresh all-time high. However, Nifty small cap index is still ~16% away from life-time highs. Hence, we expect catch up activity to be seen in small caps

* We believe any extended breather from here on would get anchored around key support threshold of 14900, as it is confluence of 23.6% retracement of post Budget rally (14470-15432), at 14998 coinciding with last week’s low of 14977 In the coming session, Nifty future is likely to open on a negative note tracking weak global cues.

* We expect index to extend the ongoing breather amid stock specific. Hence, after a gap down opening use intraday pullback towards 15140-15165 to create short position for target of 15052.

NSE Nifty Daily Candlestick Chart

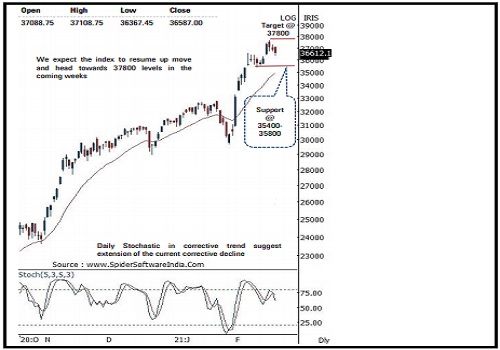

Bank Nifty: 36587

Technical Outlook

* The Nifty Bank index witnessed breather for the third consecutive session to close the weekly derivative expiry session lower by 0 . 9 % on Thursday . PSU banks index continue with its outperformance and close with gain of 5 . 6 % while private banks lagged with 1 . 1 % cut . Bank Nifty index closed at 36587 down by 324 points or 0 . 9 %

* The price action resulted in a bear candle with a lower high - low indicating extension of the current breather after a sharp rally of more than 2300 points in just three sessions .

* Key point to highlight is that the index has already taken three sessions to retrace just 50 % of the previous three sessions up move (35428 -37708 ) . A slower retracement signals a robust price structure and a higher base formation

* Going forward, we expect buying demand to emerge at lower levels and the index to trade with positive bias . Hence, buy on decline would be a prudent strategy to follow for target of 37800 , which is implication of last week’s range breakout (1200 points) projected from breakout level of 36600 signalling upside towards 37800

* Structurally, rising peak and trough formation in the longer term chart signifies robust price structure from medium term perspective .

* The key short term support for the index is placed around 35400 -35800 levels as it is the confluence of the following : a) 23 . 6 % retracement the previous rally 29687 to 37708 is placed around 35800 levels b) Last week’s low placed at 35428 levels c) The bullish gap area of 5 th February 2021 is also placed at 35413 -35545 levels

* In the coming session, the index is likely to open on a soft note tracking weak global cues . We expect the index in intraday to trade with in a range with corrective bias . Hence after a soft opening, we recommend to utilize intra day pullback towards 36730 -36790 for creating intraday short positions in Bank Nifty February Futures for target of 36520 meanwhile stop loss is placed at 36910

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct