Equity benchmarks concluded last trading session of FY20-21 on a subdued note - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Technical Outlook

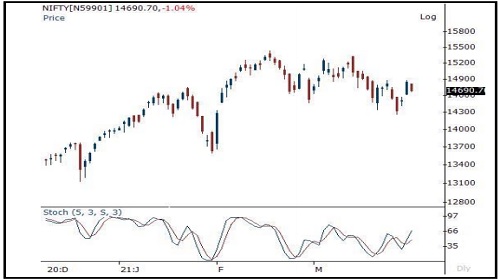

Equity benchmarks concluded last trading session of FY20-21 on a subdued note as Nifty skid 154 points or 1% to settle Wednesday’s session at 14691. In the coming session, volatility is likely to remain high owing to weekly expiry, stock specific action would remain in focus. We expect the index to trade with positive bias after the strong opening.

Hence, use intraday dip towards 14770-14792 to create long for target of 14881 Going ahead, we reiterate our positive stance on the market and expect Nifty to gradually retest lifetime highs of 15430 in coming weeks.

We believe, next leg of up move towards 15400 would not be in a linear manner as round of intermediate pullbacks cannot be ruled out. Hence, traders can use bouts of volatility to their advantage to build long positions by accumulating quality large cap and midcap stocks. Major support for the index is placed at 14400 levels.

Nifty Daily Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct