Equity Monthly Views by Sorbh Gupta, Quantum Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Equity Monthly Views by Sorbh Gupta- Quantum Mutual Fund

Equity Monthly Outlook –May 2021

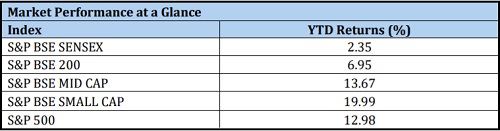

S&P BSE Sensex declined by -1.45% on a total return basis in the month of April 2021. The kind of humanitarian crisis & economic cost of lockdowns we are facing, the equity markets have shown remarkable resilience. On a trailing twelve-month (TTM) basis, the index has returned 46.26%. A favourable base of April-May 2020 is getting reflected in the TTM return. S&P BSE Sensex performance was worse than developed market indices such as S&P 500 & Dow Jones Industrial Average which appreciated by 5.2% & 2.7% respectively, during the month. A better vaccine proliferation in the US is resulting in more confidence in their economic recovery which is getting reflected in US equity markets.

Last month the broader market has done better than the Sensex. The S&P BSE Midcap Index appreciated by 0.69% and the S&P BSE Small-cap Index rose by 4.97%. Healthcare & metals were the winning sectors for the month. The resurgence of Covid-19 has brought the focus back on healthcare whereas, metals have reacted positively to the up move in global commodity prices. Capital goods & real estate stocks underperformed during the month, as state-level lockdowns made investors nervous about its impact on near-term business prospects.

Quantum Long Term Equity Value Fund saw a 0.33% appreciation in its NAV in April. This compares to a 0.17% appreciation in its benchmark S&P BSE 200TRI. Outperformance for the month was driven by holdings in materials & metals. Cash in the scheme stood at approximately 6% at the end of April. Our approach remains to position the portfolio towards economic recovery without undermining the risk associated with pandemicrelated economic upheavals.

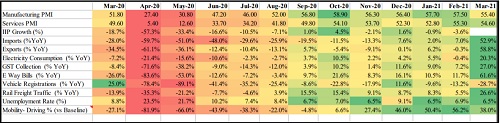

Multiple state-level restrictions on mobility are impacting economic activity: The economic indicators have broadly in growth mode in March 2021. Both the services & manufacturing PMI show expansion. However, the data points will get increasingly mixed from April 2021 onwards as more and more states have placed strict restrictions on movement to arrest the rapidly rising covid-19 cases. The data points should be better than March-April 2020 as the lockdowns are not as severe. The manufacturing activities & transportation of goods have been allowed. The essentials activity has also not been disturbed.

Inflation emerging as key risk:

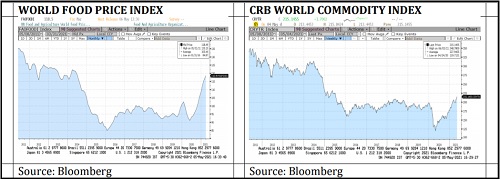

All the commodities have seen a sharp run-up post the pandemic-related fall in MarchApril 2020. The metal & energy price inflation will eventually find a way into manufactured product inflation as companies turn to increase prices to protect margin. A bigger risk in India is the rise in global food prices. In the last 8 years, food prices have been benign. However, in the last 8 months, the world food price index has moved up rapidly. Though India is self-sufficient in food grains, it imports large quantities of edible oil & pulses and this will result in domestic food inflation higher. This will push RBI to increase the interest rate sooner than later.

Foreign flows have come to a pause:

Indian Equities have seen $1.6 bn of net selling by foreign investors in April. This is the first time after September 2020 that FPIs have turned negative every month. On a YTD basis, FPI inflows stand at US$ 5.5 bn. DIIs have been buyers in the month of April. They have bought stocks worth US$ 1.5 bn this month. India’s economic recovery can face nearterm headwinds due to the Covid-19 second wave and ensuing lockdowns, this might result in short-term FII hedge funds pulling out capital from Indian markets. However, in the medium & long term, India’s nominal GDP growth will look better than the western world. This makes it a sought-after destination for yield & growth-seeking long-term global investors. The conclusion being, strong FII inflows can continue after a brief pause.

Covid 19 Second Wave or Tsunami:

In a matter of two months, India’s Covid-19 response has moved from being worthy of bouquets to brickbats. Reasons range from complacency to historic underinvestment in medical infrastructure. The infection this time is moving to the hinterland, where medical infrastructure is virtually non-existent and reporting is sketchy. As of 5th May 2021, 163 mn vaccine dosages have been administrated. And the daily vaccination rate is hovering around 3-4 mn. While this is quick (India is inoculating equivalent to the Canadian population every 10 days) the large populace means at this rate it will take a little over a year for everyone to get a single jab and two years to completely vaccinate all inhabitants.

Equity markets are resilient:

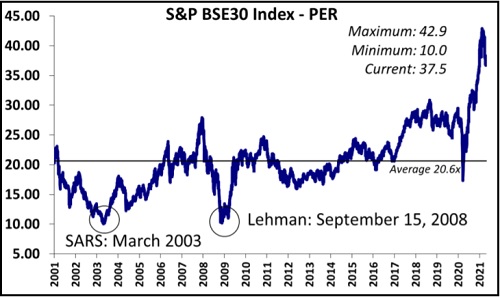

The Resurgence of Covid-19 & ensuing lockdown on economic activity gives a sense of Déjà vu. The difference this time being equity markets have shown remarkable resilience. We enumerate the following reasons for the same:

* The lockdowns are lesser stringent and more localized this time

* Corporate Balance-Sheets are better. The focus has been on debt reduction and liquidity

* The last one year has been all about cost control and business continuity for corporate India.

* Pvt. Banks & NBFC’s have raised capital and are best capitalized in the last 10 years.

* As global recovery is intact, export companies and commodity producers are comfortably placed

Universal vaccination remains the end game for the pandemic. Given India’s large populace (1.34 bn) it will take some time. India’s bureaucratic & political system works best when its back is against the wall. After a huge outcry & global media shaming, the vaccination capacity is being ramped up, medical supplies like oxygen and anti-viral drugs are being increased. Indian businesses & consumers will have to endure this pandemic & related anxiety for some more time. We recommend the long-term investors stay put & use a staggered approach to invest towards their equity allocation.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">