India`s private players see big opportunities in Nepal`s power sector with eye on region

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

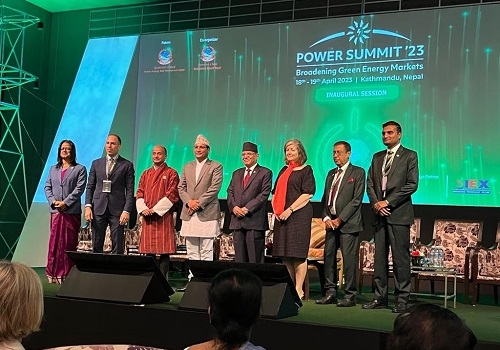

Indian private and government owned companies have been queueing up ahead of Nepals Power Summit that has unrolled in Kathmandu today.

The organiser - Independent Power Producers Association Nepal (IPPAN), an umbrella organisation of private sector power developers - said that there has been substantial representation of both government-owned and the private sector companies of India involved in the power sector.

"The Indian companies are in the largest number to participate in the event whose country partner is the Embassy of India, Kathmandu," says Ashish Garg, vice-chairperson of IPPAN. "Companies like SJVN Limited, NHPC Limited, Tata Power among others are participating in the power summit," he observed in a conversation with India Narrative.

Large scale participation of the Indian companies in one of the largest events in the power sector is taking place at a time when Nepal and India are moving towards increased partnership in the energy sector.

Indian companies, particularly the state-owned companies, are increasingly willing to develop the large scale hydropower projects in Nepal since the two countries agreed to jointly develop such projects in the last one year.

The two neighbours decided to form a joint technical team to develop large hydropower projects in Nepal during the secretary-level ninth Joint Steering Committee meeting held in Kathmandu in February 2022.

Subsequently, during the India visit of the then Nepali Prime Minister Sher Bahadur Deuba in early April last year, they unveiled a Joint Vision Statement on Power Sector Cooperation.

It seeks to strengthen mutually beneficial bilateral cooperation in the energy sector through joint development of power projects in Nepal.

Development of cross-border transmission infrastructure, bi-directional power trade with appropriate access to electricity markets in both countries, coordinated operation of the national grids and institutional cooperation in sharing latest operational information, technology and know-how are other areas of cooperation included in the joint vision statement.

The two countries also agreed to expand such cooperation to include partner countries under the BBIN (Bangladesh, Bhutan, India and Nepal) framework, subject to mutually agreed terms and conditions, raising hope that Nepal could also export power to Bangladesh.

"It turned out to be a milestone for the growing interest of Indian companies' to develop big hydropower projects in Nepal," said Garg. "Rapid implementation of the 900MW Arun 3 Hydropower Project in eastern Nepal by SJVN limited is also encouraging other state-owned Indian companies to develop power projects in the country."

He however said that the Indian private sector power producers are facing some teething problems. For instance, GMR Energy is struggling to conclude financial closure to develop the 900MW Upper Karnali Hydropower Project in western Nepal.

But India's state owned energy companies moved aggressively into Nepal's hydropower project development after the release of the joint vision statement.

In early May last year, the NHPC Limited, an Indian government owned entity, under the Ministry of Power, submitted a proposal to develop the 750MW West Seti Hydropower Project along with 450MW Seti River-6 project.

In August last year, Investment Board Nepal, the government agency responsible for dealing with large scale investment proposals, signed a memorandum of understanding (MoU) with the NHPC authorising the Indian company to study and develop these two projects as a package.

Four years after China's Three Gorges Corporation pulled out from the West Seti Project in 2018, an Indian company has moved ahead to develop this project.

Likewise, a board meeting of the IBN last week asked the NHPC to prepare a detailed project report of these two projects.

Likewise, in May last year, Nepal and India signed a memorandum of understanding to develop the 695MW Arun-4 hydropower project, which lies downstream of under construction - Arun-3 project.

As per the agreement on Arun-4 development, it will be jointly developed by Nepal Electricity Authority (NEA), state-owned power utility body of Nepal and SJVN Limited.

The SJVN and the NEA will have 51 percent and 49 percent stakes, respectively. Nepal will receive 21.9 percent, or 152 megawatts, of electricity for free, as per the agreement.

"Currently, the Indian company is updating the existing studies regarding this project," Prabal Adhikari, power trade director of the NEA, told the India Narrative.

The SJVN has also been licensed to develop 679MW Lower Arun on the same river. The SJVN will now be involved in developing a combined 2274.2MW of electricity in Nepal, close to the entire generation capacity of the country currently. Nepal's entire installed capacity of operating power projects has reached 2,650MW as of early April, according to the NEA.

On the other hand, Nepal is also preparing to award 480 MW Phukot Karnali Hydropower Project to be built in western Kalikot district to the Indian company-NHPC Limited.

Nepal's state-owned Vidyut Utpadan Company Limited (VUCL) has decided to join hands with the NHPC to develop the project jointly. "We have sent a draft of the MoU to the cabinet through the energy ministry," Surya Prasad Rijal, managing director of VUCL told the India Narrative.

The MoU could be signed during the planned visit of Nepali Prime Minister Pushpa Kamal Dahal 'Prachanda' to India whose date has not been finalised yet, officials of Nepal's energy ministry, said.

Following the MoU, a joint venture company will be registered in Nepal and move to take approval for the investment proposal from the IBN. Earlier, Nepal had enlisted this project as a potential project that could be developed under China's Belt and Road Initiative, of which Nepal is a signatory.

According to Rijal, the NHPC had also shown interest to develop 1,902MW Mugu Karnali Storage Hydro Electric Project in western Karnali river in 2021.

"The NHPC had submitted a letter to Nepal's energy ministry showing interest to develop this project but no further talks regarding this project have moved ahead," he said. "Currently, its feasibility study is undergoing."The Nepali government had awarded the survey licence to the VUCL in July 2018.

Coinciding with Chinese President Xi Jinping's visit to Nepal in October 2019, Nepal's Hydroelectricity Investment and Development Company Limited (HIDCL) and Power Construction Corporation of China Limited entered into an MoU for joint development 756 MW Tamor Storage Hydroelectric Project in eastern Nepal by forming a Special Purpose Vehicle Company.

As hardly any progress was achieved in the last four years on steps designed to be taken to implement the project, the HIDCL, about a month ago, sent a letter to the IBN expressing its willingness to terminate the deal with the Chinese company.

"As we cannot develop this project alone, we are open to the idea of joining hands with the Indian companies," said Arjun Kumar Gautam, chief executive officer of HIDCL.

As the Indian companies increasingly seek to develop large hydropower projects in Nepal, questions have also been asked from certain quarters whether relying on a single country for the market would increase Nepal's vulnerabilities.

But Rajendra Kishore Chhetri, Nepal's former chief secretary, who has expertise in the power sector, said that inviting Indian companies to develop the hydropower projects in Nepal was a natural choice.

"For the developers of other countries, the Indian market has not been guaranteed. So, it is natural to invite Indian companies to develop hydropower projects in Nepal. India is also hungry for green energy."

India is making a big push towards renewable energy as it aims to achieve carbon neutrality by 2070. Besides hydropower, India has been prioritising the development of solar and wind energy. "Nepal's hydropower will contribute to balance the solar and wind energy in India," said Adhikari of the NEA.

Since July 2021, Nepal has been producing surplus power in the wet (summer) season. India has allowed to sell 452.6MW of electricity to India's power exchange market. Nepal needs to sell more to avoid spilling of energy in the next summer.

According to the NEA, Nepal's projected power generation capacity is expected to reach 2,853MW by the end of the current fiscal year ending in mid-July this year. By the end of this fiscal, peak domestic demand is expected to reach 2,853MW. That's why, there is a compulsion for Nepal to sell its surplus power to India in the wet season while India is seeking more green energy. "It is a win-win situation for both countries," said Chhetri, the former chief secretary of Nepal. In the last wet season (June-November 2022) , Nepal exported electricity worth over NPR 11 billion to India, as power became one of the country's largest export products.

"Power is likely to be the most important export product in the next several years as it is difficult to boost exports of other products like electricity," said Adhikari, adding that Indian companies investing in Nepal could play a vital role for this purpose.

Stakeholders in Nepal's power sector say that the Indian companies have both capacity and experience of developing large hydropower projects. "Their involvement in hydropower development in Nepal will also help to broaden market access to Nepal's electricity not only in India but also in Bangladesh which itself is seeking ways to import Nepal's electricity," said Chhetri.

During the 10th Joint Steering Committee meeting held in India in February this year, New Delhi was positive to grant permission for Nepal to export 50 MW of electricity to Bangladesh through existing Indian transmission infrastructure. Nepali officials said that the southern neighbour agreed to grant its approval once Nepal submits the proposal along with the project whose power will be sold to Bangladesh.

Nepali officials say sale of electricity to China is however remote because of no cross-border connectivity between the two countries.

"As Nepal has to export its surplus power to India predominantly, it makes sense to invite Indian companies to develop power projects in Nepal," said Garg, the vice-president of IPPAN.

"Indian investment in Nepal's hydropower sector is also important from the perspective of attracting foreign direct investment in the country as well as Indian companies enjoy one advantage over companies from other countries because the Indian investors should not be worried about foreign exchange risks as Nepali currency has fixed exchange rate regime with the Indian currency."

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">