Dollar steady on higher-for-longer rates outlook; yen volatile

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

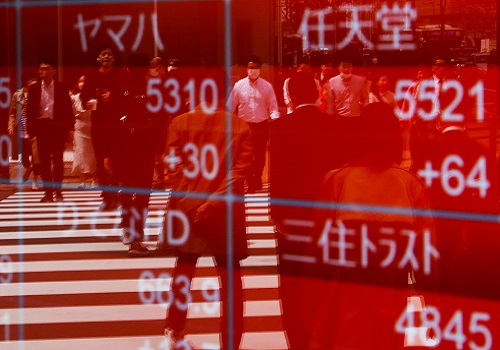

The dollar held firm on Friday as investors braced for U.S. interest rates to be higher for longer, while the yen was volatile, with incoming Bank of Japan Governor Kazuo Ueda saying it was appropriate to maintain an ultra-loose monetary policy.

Ueda, who was nominated earlier this month in a surprise move, warned that uncertainties regarding Japan's economic recovery remained "very high", warranting the BOJ maintaining its ultra-loose monetary policy.

The yen was volatile on the day and swung between gains and losses against the dollar as investors parsed through the comments from Ueda, who was speaking at the lower house confirmation hearing. It was last off 0.03% at 134.76 per dollar.

The hearing comes as Japan's core consumer inflation hit a fresh 41-year high in January, according to data on Friday, putting renewed pressure on the central bank to phase out its massive stimulus programme.

Analysts said Ueda's comments were not a surprise, noting that he stuck to BOJ's current stance.

OCBC currency strategist Christopher Wong said Ueda was likely to adopt a gradual and moderate approach as he monitors further data to get a better gauge of economic conditions in Japan.

"It is still early days to form an impression of his policy leaning at this point."

The surprise choice of Ueda as the next BOJ governor stoked expectations that the end to the unpopular yield curve control (YCC) policy was around the corner.

Meanwhile, data overnight showed that the number of Americans filing new claims for unemployment benefits unexpectedly fell last week, underscoring a still-tight labour market and a resilient U.S. economy.

The recent spate of strong U.S. economic data and hawkish rhetoric from Fed officials have led the dollar to erase its year to date losses.

The dollar index, which measures the U.S. currency against six other rivals, was up 0.019% at 104.580 and was set for a fourth straight week of gains. The index is now up 2.5% for the month.

"While slower activity and higher inflation components seem to be making the Fed's task more difficult, labour market still remained strong which suggests that any slowdown in growth will be likely very slow," strategists from Saxo Markets said in a note.

The euro was up 0.04% at $1.0599, while sterling was last trading at $1.2016, up 0.02% on the day. The Australian dollar rose 0.10% to $0.681. The kiwi advanced 0.14% to $0.624.

========================================================

Currency bid prices at 0153 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar $1.0603 $1.0594 +0.09% -1.04% +1.0615 +1.0593

Dollar/Yen 134.6950 134.4900 +0.29% +2.78% +134.8850 +134.1100

Euro/Yen 142.86 142.70 +0.11% +1.82% +142.9100 +142.1700

Dollar/Swiss 0.9336 0.9340 -0.04% +0.97% +0.9342 +0.9327

Sterling/Dollar 1.2019 1.2018 +0.02% -0.61% +1.2032 +1.2010

Dollar/Canadian 1.3535 1.3550 -0.07% -0.07% +1.3547 +1.3529

Aussie/Dollar 0.6818 0.6808 +0.15% +0.02% +0.6823 +0.6805

NZ 0.6239 0.6227 +0.19% -1.74% +0.6240 +0.6226

Dollar/Dollar

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">