Debt Monthly Observer for April - 2022 by Mr. Pankaj Pathak, Quantum Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Debt Monthly Observer for Apr- 2022 by Mr. Pankaj Pathak, Fund Manager- Fixed Income, Quantum Mutual Fund.

Inevitable Pivot: Resetting Market Expectations

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation. It though has not yet changed the key policy rates. However, there were bits and pieces in the monetary policy statement of April 8 th and the post-policy RBI media conference, indicating that the monetary policy regime has changed.

In this regard, we found the following statements noteworthy:

“In the sequence of priorities, we have now put inflation before growth.” - Governor Shaktikanta Das

“With the broad-based surge in prices of key industrial inputs and global supply chain disruptions, input cost-push pressures appear likely to persist for longer than expected earlier.”

“Now that the situation is changing and inflation particularly is at risk, we want to withdraw the ultra-accommodation” - Deputy Governor in charge of monetary policy, Michael Patra

“The MPC decided to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth.”

Clearly, RBI’s focus going forward would be to control inflation and roll back some of the COVID time monetary policy accommodation. Its commentary was explicit in suggesting that the rate hiking cycle is about to begin.

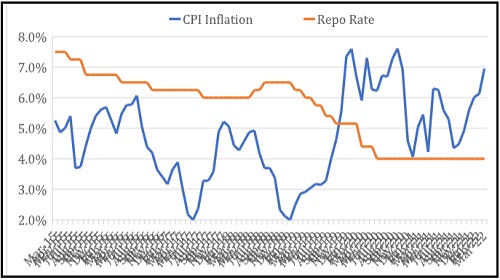

We would expect a change in monetary policy stance to ‘neutral’ and a 25 basis points repo rate hike in June policy itself. If Crude oil price sustains above US$100/barrel, we would expect the repo rate to be around 5% before March 2023.

Chart –I: Elevated Inflation to force RBI into hiking interest rates

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

More News

Wholesale Price Index numbers for January 2021 By Krupesh Thakkar, ITM B-School