Debt Monthly Observer : June 2022 - Looking Beyond FED By Mr. Pankaj Pathak, Quantum Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The US treasury secretary John Connally proclaimed at the G-10 meeting held in Rome in late 1971- “The dollar is our currency, but it’s your problem”.

50 years have passed since, but the movements in the US dollar continue to worry policymakers across the world.

The US economy is about a quarter of the world GDP. The US Dollar is used for the settlement of over 40% of all international trades and it accounts for about 60% of total central bank reserves worldwide.

Thus, whatever the FED does to the US interest rates and hence its impact on the US Dollar has repercussions for the entire world.

It gets even more troubling, at a time when the Federal Reserve (FED) is fighting the highest inflation in the US, in 40 years.

FED’s inflation fight

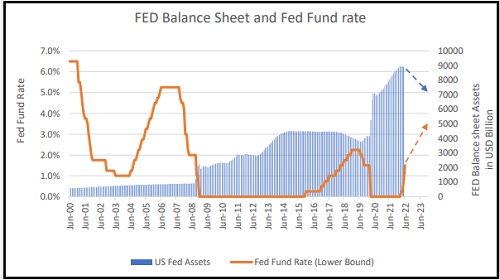

On June 15, 2022, the FED hiked the federal funds rate (the interest rate at which commercial banks borrow and lend their overnight excess reserves) by 75 basis points, the largest one-off rate hike since 1994.

Since March this year, the federal funds rate has been raised by a cumulative 150 basis points from the range of 0%-0.25% to 1.50%-1.75%.

CPI inflation in the US is still above 8% and the US economy is creating about two jobs for every single person looking out for a job. So, the FED has every reason to continue hiking rates till they get inflation under control. To recall, the FED targets to keep inflation at 2%.

As per FED’s own projection, the federal funds rate will be at 3.4% by December 2022. This implies another 175 basis points rate hike over the next six months. Alongside, the Fed has also started the process to reduce its gigantic USD 9 trillion balance sheet by letting the bonds in its portfolio mature and not reinvest the money. The pace of balance sheet runoff is set at USD 47.5bn per month until September when it will ramp up to a total of USD 95bn per month.

At this pace, FED’s balance sheet assets will fall by USD 1.6 trillion by the end of 2023. This means the Fed will take away USD 1.6 trillion of liquidity from the global financial system.

Chart – I: US FED intends to hike the interest rate by over 300 basis points and take out USD 1.6 trillion of liquidity

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...