Debt Market Observer: RBI Sprint - Market Tremors By Pankaj Pathak, Quantum AMC

Below are Views On Debt Monthly Observer for April 2022 by Pankaj Pathak - Fund Manager - Fixed Income, Quantum Mutual Fund

RBI Sprint -Market Tremors

Bond yields are surging-what should investors do?

In the last month’s edition of the Debt Market Observer – Inevitable Pivot, we cautionedthat “The path forward for bonds is filled with uncertainties….there will be surprises, there will be miscommunications and there will be market overreactions.”

We witnessed some of that in the last two weeks.

The RBI surprised the market with an off-schedule 40 basis points hike in the policy Repo rate (Rate at which banks borrow from the RBI.). The Repo rate now stands at 4.40%. It also raised the Cash Reserve Ratio (CRR - portion of deposits banks have to keep with the RBI as reserves) by 50 basis points from 4.00% to 4.50%.

Expectations Reset

After the April monetary policy, rate hikes looked imminent. The bond market prepared itself andpriced for higher rates. The interest rate swap curvewas pricing for more than 200 basis points of a cumulative rate hike,before the RBI’s announcement.

Yet, after the announcement bond yields shoot up and prices dropped. The 10-year government bond yield rose 26 basis points in intraday trade after the policy announcement. 3-5 year bonds sold off even more with over 33 basis points intraday jump in yields.

So, why this market reaction?

There are nuances in this policy announcement that changed the market reading of the RBI.

The RBI chose to-

- hike rate out of schedule;that too just a few hours before the US federal reserve’s policy

- hike by 40 basis points not the conventional 25 basis points

- raised CRR to absorb excess liquidity

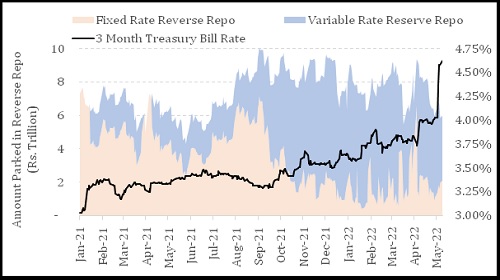

These should be seen together with the April monetary policy move. In April the RBI introduced Standing Deposit Facility (SDF) as a tool to absorb excess liquidity from the banking system. The SDF rate is set at 25 basis points below the Repo rate.

This itself was equivalent to a 40 basis points hike in the marginal overnight rate as the floor monetary policy rate moved up from the reverse repo rate of 3.35% to the SDF rate of 3.75%. Now, with a 40 basis points hike in the repo rate, the SDF rate is set at 4.15%. This implies a cumulative 80 basis points rate hike in 4 weeks.

Source – Reserve Bank of India, Bloomberg, Quantum Research; Data upto May 9, 2022

Past performance may or may not sustain

This shows a sense of urgency within the RBI to unwind the ultra-easy monetary policy of low rates and high surplus liquidity, quickly. There was also a realization that the RBI will not be hesitant to use ‘surprise’ as a policy tool.

Given the inflation uncertainty and the fact that RBI is behind its peers in unwinding the pandemic stimulus, the urgency to act is justified.

In his media statement, RBI Governor Shaktikanta Das said – “There is the collateral risk that if inflation remains elevated at these levels for too long, it can de-anchor inflation expectations which, in turn, can become self-fulfilling and detrimental to growth and financial stability.”

Clearly, the RBI has joined other global central banks in the war against inflation.We expect that the RBI would frontload the rate hikes with another 75-100 basis points hike by the year-end.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

More News

Views on Morning Market 26th December 2025 by Dr. VK Vijayakumar, Chief Investment Strategis...