Dalmia Bharat gains as its arm executes definitive agreements with Jaiprakash Associate

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

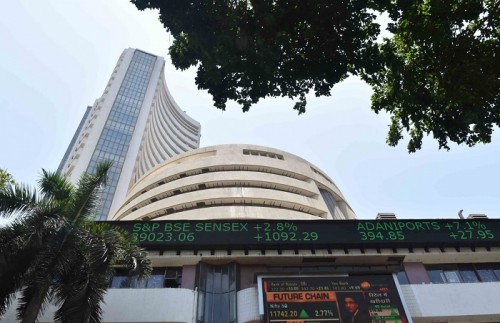

Dalmia Bharat is currently trading at Rs. 1942.30, up by 9.05 points or 0.47% from its previous closing of Rs. 1933.25 on the BSE.

The scrip opened at Rs. 1946.65 and has touched a high and low of Rs. 1963.05 and Rs. 1936.70 respectively. So far 3309 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 2 has touched a 52 week high of Rs. 2168.00 on 21-Apr-2023 and a 52 week low of Rs. 1212.60 on 20-Jun-2022.

Last one week high and low of the scrip stood at Rs. 2168.00 and Rs. 1885.95 respectively. The current market cap of the company is Rs. 36446.18 crore.

The promoters holding in the company stood at 55.86%, while Institutions and Non-Institutions held 21.54% and 22.60% respectively.

Dalmia Bharat’s subsidiary -- Dalmia Cement (Bharat) (DCBL) has executed definitive agreements with Jaiprakash Associates (JAL) for the acquisition of JP Super Cement Plant in Uttar Pradesh at an enterprise value of Rs 1,500 crore and costs and expenses of up to Rs 190 crore. However, this will be subject to various clearances and approvals related to JP Super plant and mines.

As part of that, DCBL also executed a share purchase agreement for acquisition of 74 per cent shareholding of Bhilai Jaypee Cement (BJCL) at an enterprise value of Rs 666 crore. DCBL is in process of signing a long-term lease agreement (having a term of seven years) with Jaiprakash Power Ventures for its Nigrie Cement Grinding Unit of 2 million MTPA (Nigrie Unit) located at Singrauli in Madhya Pradesh, which is subject to fulfilment of certain conditions precedent. DCBL has the option to purchase the Nigrie Unit anytime within the lease period at an enterprise value of Rs 250 crore.

Dalmia Bharat has emerged as one of the most respected cement manufacturers in India, contributing to nation-building through adequate capacity creation, consistently high quality standards and value-added products.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">