Credit Wise Capital forms a co-lending partnership with Muthoot Capital for INR 400CR agreement to offer two-wheeler loans to customers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

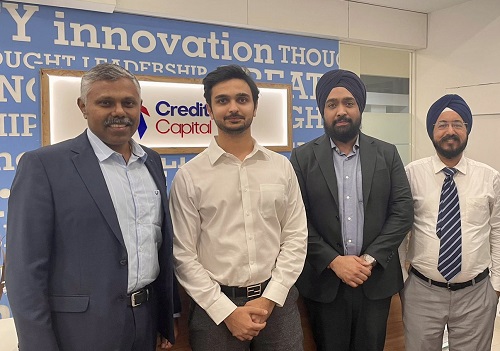

Credit Wise Capital (CWC), a leading non-banking financial company (NBFC) specializing in two-wheeler financing, and Muthoot Capital, a distinguished financial institution, have announced a co-lending partnership for a significant INR 400cr investment agreement. This strategic partnership aims to provide seamless financing solutions to customers purchasing two-wheelers across India in a digital manner through Twin2 - a proprietary product of CWC that ensures a hassle-free experience for the customers.

This partnership comes as a testament to Credit Wise Capital's exceptional growth trajectory and its commitment to providing accessible financial solutions for individuals seeking to purchase two-wheelers. The objective of the partnership is to combine Credit Wise Capital and Muthoot Capital’s individual strengths to deliver a smooth and effective lending process to customers purchasing two-wheelers across India. This partnership will also enhance Credit Wise Capital’s product offerings and expand its market reach and augment its operational capabilities.

Mr. Aalesh Avlani, Co-Founder, of Credit Wise Capital, expressed his excitement about the partnership, stating, "The two-wheeler market holds great untapped potential, and this partnership with Muthoot Capital is aimed to capitalize on that. Together, we will expand our customer base and offer enhanced financing solutions, along with a strong credit assessment framework and streamlined loan processing services”.

Mr. Gurpreet Singh Sodhi, Co-Founder, of Credit Wise Capital, expressed his views about this stating, “With the steady rise in demand for two-wheelers in India, Credit Wise Capital has emerged as a trusted financial partner for individuals seeking affordable and convenient financing solutions. The co-lending partnership agreement with Muthoot Capital will enable us to reach a wider customer network in smaller towns of India”.

Mr. Mathews Markose, Chief Executive Officer, Muthoot Capital Services Ltd said, “Muthoot Capital is a diversified financial institution and recognizes the potential of the two-wheeler financing segment and has chosen to co-lend with Credit Wise Capital to capitalize on this opportunity. This strategic partnership showcases Muthoot Capital's commitment to supporting the growth and development of innovative financial services in India”.

Muthoot Capital, under separate arrangement, uses the vast network of branches of their flagship Company Muthoot FinCorp to sell two-wheeler products across the country.”

The partnership between Credit Wise Capital and Muthoot Capital marks a significant milestone for both organizations and signifies their commitment to driving financial inclusion and empowering individuals with affordable mobility solutions. By combining their strengths, the companies aim to transform the two-wheeler financing landscape, making it more accessible and efficient for customers across India.

Credit Wise Capital and Muthoot Capital are committed to maintaining the highest standards of customer service, transparency, and compliance with regulatory requirements. They will work closely together to ensure seamless integration of their operations and to maximize the benefits of this partnership for all stakeholders, including customers, employees, and shareholders.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">