Cotton trading range for the day is 23260-24000 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

COTTON

Cotton yesterday settled up by 0.51% at 23710 as sowing of cotton may be delayed in India as the southwest monsoon, is set to reach the mainland two days later than usual. Cotton Cooperation of India has increased prices by 200- 500 Rs Candy across all growths of all Zones for 2020-21 season and for 2019-20 season. Cotton crop is at risk due to water shortage in Sindh and Punjab. The increasing trend in the rate of cotton remained continued in international markets. Agriculture Minster Punjab Hussain Jahanian Gardezi said that Punjab is facing water shortage of 22 % while Sindh is facing shortage of around 17%.According to the Third Advance Estimate released by the government, cotton production is estimated at 36.49 million bales higher by 4.59 million bales than the average cotton production. In the previous season 2019-20 cotton production was estimated at 36.07 million bales. The U.S. Department of Agriculture's (USDA) weekly export sales report showed net sales of 171,200 Running Bales for the 2020/2021 marking year, 59% higher than the prior week. CAI has revised higher Indian cotton export estimates for 2020-21 season at 65 lakh bales against 60 lakh bales projected till last month. Cotton production in Haryana is expected to decline by 27 percent to 1.8 million bales in 2020-21 (JulyJune) season due to yield loss. In spot market, Cotton gained by 150 Rupees to end at 23500 Rupees.Technically market is under short covering as market has witnessed drop in open interest by -1.58% to settled at 7268 while prices up 120 rupees, now Cotton is getting support at 23490 and below same could see a test of 23260 levels, and resistance is

Trading Idea for the day

Cotton trading range for the day is 23260-24000.

Cotton gains as sowing of cotton may be delayed in India as the southwest monsoon, is set to reach the mainland two days later than usual

The country’s cotton exports are likely to be 20 percent higher at 1.02 million tonnes in 2020-21

Cotton crop is at risk due to water shortage in Sindh and Punjab

Cocudakl

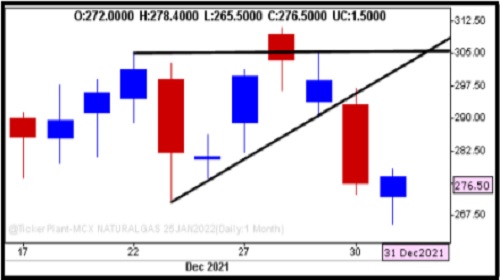

Cocudakl yesterday settled up by 0.58% at 2771 tracking rise in cotton prices amid prospects of higher exports and falling supply in the physical market. However there were worries of lockdown it is anticipated that there will be slow supply and same with demand. Cottonseed production and quality were affected last year due to excessive rains in the key producing State of Telangana and some parts of Tamil Nadu. 2021/22 global cottonseed production is projected at nearly 44 million tons, up 5 percent from the current year. Higher forecasts for the United States, Brazil, Australia, and Mali are partially offset by declines in China. U.S. production is forecast up 781,000 tons to nearly 5 million. Waning arrivals of raw cotton due to the fag end of the season and limited stocks of cottonseed with ginners has led to a supply crunch in the market. India has produced around 36 mln bales in the ongoing 2020-21 (Oct-Sep) season, of which nearly 33 mln bales, or 92% of the stock, has already arrived in the market. Considering firm demand outlook for the commodity, the tight supply situation in cottonseed is expected to continue in the coming months as well as the new season for cotton will start only in October. In Akola spot market, Cocudakl gained by 6.9 Rupees to end at 2831.6 Rupees per 100 kgs.Technica

Trading Idea for the day

Cocudakl trading range for the day is 2699-2831.

Cocudakl gained tracking rise in cotton prices amid prospects of higher exports and falling supply in the physical market.

However there were worries of lockdown it is anticipated that there will be slow supply and same with demand.

2021/22 global cottonseed production is projected at nearly 44 million tons, up 5 percent from the current year.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">