Cotton trading range for the day is 21930-22590 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Cotton

Cotton yesterday settled up by 0.82% at 22220 on hopes demand would benefit from a global economic rebound amid concerns over a shortage in supply. India’s cotton exports may increase by about 30 per cent for the current crop year (October 2020-September 2021) as rising global prices have made the fibre competitive. Exports could be between 65 and 70 lakh bales compared with 50 lakh bales the previous year. The bullishness on cotton exports, after traders pruned their projections to 54 lakh bales last month, follows cotton prices in New York topping 89 cents per pound (₹45,924 a candy of 356 kg). CCI, under the Centre’s procurement scheme at minimum support prices (MSP), has purchased 91.8 lakh bales accounting for nearly 25 per cent of the projected crop this year. The Committee on Cotton Production and Consumption (CCPC) has estimated this year’s production at 371 lakh bales compared with 365 lakh bales last year. The Cotton Association of India (CAI), a body of traders, has retained its production estimate at 360 lakh bales. India holds an advantage with high carryover stocks of over 110 lakh bales from last year. CCPC has projected the carryover stocks from last season at 125 lakh bales, while CAI has pegged it at 113.50 lakh bales. In spot market, Cotton gained by 230 Rupees to end at 22110 Rupees. Technically market is under fresh buying as market has witnessed gain in open interest by 0.78% to settled at 9428 while prices up 180 rupees, now Cotton is getting support at 22070 and below same could see a test of 21930 levels, and resistance is now likely to be seen at 22400, a move above could see prices testing 22590

Trading Idea for the day

* Cotton trading range for the day is 21930-22590.

* Cotton gains on hopes demand would benefit from a global economic rebound amid concerns over a shortage in supply.

* India’s cotton exports may increase by about 30 per cent for the current crop year

* CCI has purchased 91.8 lakh bales accounting for nearly 25 per cent of the projected crop this year.

Cocudakl

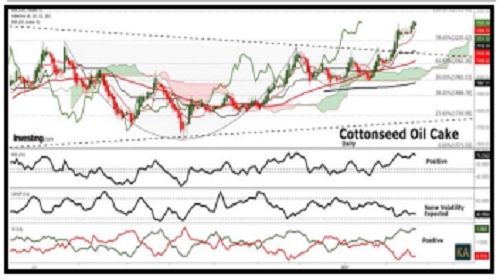

Cocudakl yesterday settled up by 2.42% at 2286 as CCI hiked base price for 2020- 21 crop by Rs 500 per candy of 356 kg. Traders CCI bought over 90 lakh bales of cotton so far this season. Cottonseed oilcake prices also moved up in last few days as the Union Budget 2021 slapped a 10% customs duty on cotton imports. Cotton prices have been supported even before the budget as on strong minimum support price (MSP) operations by the Cotton Corporation of India (CCI). The US Department of Agriculture has pegged Indian cotton production at 371 lakh bales against its initial projection of 377 lakh bales, keeping the overall sentiments supported. Cotton farmers in Guntur in Andhra Pradesh are availing the benefits of an open market by receiving a larger sum for their produce than the per quintal rate set by the Cotton Corporation of India (CCI). The CCI has fixed a price of Rs 5,825 for each quintal of quality cotton. Apparently, the cotton sowing area in the district had reduced as farmers gradually switched to sowing chili crops to get a better price in the market. Moreover, heavy rainfalls in September and October damaged the cotton crops in the southern state. In Akola spot market, Cocudakl dropped by -4.95 Rupees to end at 2373.75 Rupees per 100 kgs. Technically market is under short covering as market has witnessed drop in open interest by -6.12% to settled at 107850 while prices up 54 rupees, now Cocudakl is getting support at 2251 and below same could see a test of 2216 levels, and resistance is now likely to be seen at 2309, a move above could see prices testing 2332.

Trading Idea for the day

* Cocudakl trading range for the day is 2216-2332

* Cocudakl gained as CCI hiked base price for 2020-21 crop by Rs 500 per candy of 356 kg.

* Traders CCI bought over 90 lakh bales of cotton so far this season

* Cotton prices have been supported as on strong minimum support price (MSP) operations by the Cotton Corporation of India (CCI).

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">