Cotton trading range for the day is 21920-22500. - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

COTTON

Cotton yesterday settled up by 0.32% at 22260 as Indian exporters have up to now shipped over 75 per cent of the 65 lakh bales of cotton exports projected for the entire year 2020-21. Cotton Association of India’s (CAI) newest data confirmed shipments as on April 30 at 50 lakh bales. This means, India by April has shipped out what was exported throughout the entire of final season. The commerce physique, in its revised export projections, has estimated India’s cotton exports for the year at 65 lakh bales. “Indian cotton was the cheapest in the world. Therefore, we could take advantage of being competitive in the international market,” stated Atul Ganatra, President, CAI. With brightened worldwide price prospects, India’s cotton shipments gained momentum, thereby lifting the home prices to ₹40,800 on December 10, 2020 and ₹46,200 on May 10, 2021. “The CAI has reduced its consumption estimate for the current crop year by 15 lakh bales to 315 lakh bales of 170 kgs each from its previous estimate of 330 lakh bales . The consumption now estimated for the current crop year is, however, higher by 65 lakh bales compared to the previous year’s consumption estimate of 250 lakh bales,” stated Ganatra in a statement after the CAI Crop Committee meeting on May 11. In spot market, Cotton gained by 70 Rupees to end at 22090 Rupees.Technically market is under short covering as market has witnessed drop in open interest by -0.58% to settled at 6352 while prices up 70 rupees, now Cotton is getting support at 22090 and below same could see a test of 21920 levels, and resistance is now likely to be seen at 22380, a move above could see prices testing 22500

Trading Idea for the day

Cotton trading range for the day is 21920-22500.

Cotton prices gained as Indian exporters have up to now shipped over 75 per cent of the 65 lakh bales of cotton exports projected for the entire year 2020-21.

CAI confirmed shipments at 50 lakh bales, India by April has shipped out what was exported throughout the entire of final season.

Cotton consumption this year is likely to take a hit because of the ongoing Covid19 pandemic and lockdown in most of the States.

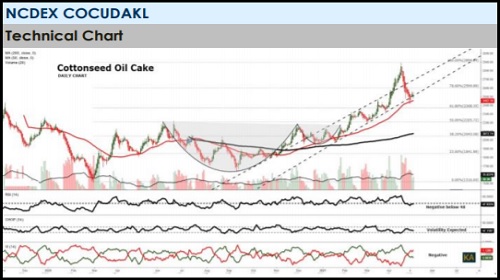

Cocudakl

Cocudakl yesterday settled down by -0.11% at 2693 dropped on profit booking after prices gained due to a scarcity of cottonseed in spot markets, amid a broad rally in the edible oil complex. A sharp rally in the edible oil complex has also supported prices of cotton wash oil, as there is higher demand for cotton seed for crushing purposes. Waning arrivals of raw cotton due to the fag end of the season and limited stocks of cottonseed with ginners has led to a supply crunch in the market. India has produced around 36 mln bales in the ongoing 2020-21 (Oct-Sep) season, of which nearly 33 mln bales, or 92% of the stock, has already arrived in the market. Considering firm demand outlook for the commodity, the tight supply situation in cottonseed is expected to continue in the coming months as well as the new season for cotton will start only in October. Farmers may increase the area under cotton in the upcoming kharif season due to forecast of a good monsoon by the India Meteorological Department, as well as expectations of higher prices. Cottonseed production and quality were affected last year due to excessive rains in the key producing State of Telangana and some parts of Tamil Nadu. In Akola spot market, Cocudakl gained by 51.05 Rupees to end at 2722 Rupees per 100 kgs.Technically market is under fresh selling as market has witnessed gain in open interest by 5.76% to settled at 100800 while prices down -3 rupees, now Cocudakl is getting support at 2676 and below same could see a test of 2658 levels, and resistance is now likely to be seen at 2721, a move above could see prices testing 2748.

Trading Idea for the day

Cocudakl trading range for the day is 2658-2748.

Cocudakl dropped on profit booking after prices gained due to a scarcity of cottonseed, amid a broad rally in the edible oil complex.

Cottonseed production and quality were affected last year due to excessive rains in Telangana and some parts of Tamil Nadu.

India has produced around 36 mln bales in the ongoing 2020-21 season, of which nearly 92% of the stock

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">