Cotton trading range for the day is 21680-22200 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Cotton

Fundamentals

Cotton yesterday settled down by -0.5% at 21910 as favorable weather in the cotton growing regions of the southern United States is expected to help the crop, while investors were awaiting a federal export sales report. The weather is getting better in the (U.S.) south with a lot of rains so, there is going to be excellent planting conditions once spring rolls up. India’s competitive advantage may not be sustained as the international cotton prices are seen falling on higher crop outlook in the next year. Trade body Cotton Association of India (CAI) has noted that so far about 60 per cent or 36 lakh bales has been shipped since the start of the season. USDA has kept production and consumption figures steady for India in the March WASDE report, but increased Indian Cotton export estimates to 57 million bales of 480 lbs compared to 50 lakh bales pegged earlier, which was already factored in by the market. The International Cotton Advisory Committee has scaled up its forecast for global prices in 2020-21 (August-July), as ending stocks for the ongoing season are estimated to be lower. The committee has revised upwards its price forecast for Cotlook A Index, global ending stocks for the season is estimated at 21.1 million tonnes, compared with 21.4 million tonnes the previous season. In spot market, Cotton dropped by -30 Rupees to end at 22160 Rupees. Technically market is under long liquidation as market has witnessed drop in open interest by -6.27% to settled at 5385 while prices down -110 rupees, now Cotton is getting support at 21800 and below same could see a test of 21680 levels, and resistance is now likely to be seen at 22060, a move above could see prices testing 22200.

Trading Idea for the day

Cotton trading range for the day is 21680-22200.

Cotton edged down as favorable weather in the cotton growing regions of the southern United States is expected to help the crop

India’s cotton exports are likely to hit 60 lakh bales (each of 170 kg) for the current season on cost competitiveness.

USDA has kept production and consumption figures steady for India, but increased Indian Cotton export estimates to 57 million bales of 480 lbs

Cocudakl

Fundamentals

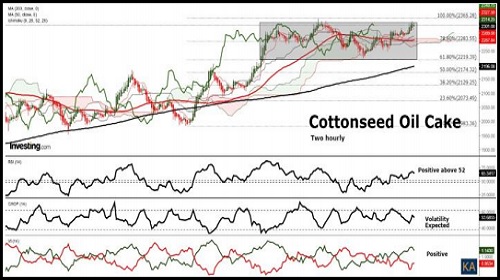

Cocudakl yesterday settled down by -1.4% at 2390 as around 25 to 30 lakh bags of cottonseed cake are lying in Kadi, its more than estimated. Considering the rise in binola and supply, the possibility of a fall in the coming days may be less market compelling. All mills of cottonseed in Kadi will be demolished in no time, after that barely seven to eight mills are expected to be operational. Khali stock is very low in centers other than Kadi. There is a possibility of one to two lakh sacks of stock in some traditional centers. Cottonseed stock is estimated to be very low all over Gujarat. Retail demand is currently very sluggish in Cottonseed Khali. Most of the ginning units across the country have been closed in the month of March due to declining cotton income. New season cotton sowing has not even started. There is still six months left for the new season. Most of the ginning units are coming off due to closure. Most of the cottonseed-khali producers of Gujarat were in a recession a month ago, they sold cottonseed and cottonseed khali extensively in Maharashtra, Madhya Pradesh and other states of the countryWith CCI introducing MSP (Minimum Support Price) to cotton farmers, farmers came to the market to sell cotton faster. In Akola spot market, Cocudakl dropped by -4.95 Rupees to end at 2473.55 Rupees per 100 kgs. Technically market is under long liquidation as market has witnessed drop in open interest by - 4.26% to settled at 119560 while prices down -34 rupees, now Cocudakl is getting support at 2375 and below same could see a test of 2360 levels, and resistance is now likely to be seen at 2412, a move above could see prices testing 2434.

Trading Idea for the day

Cocudakl trading range for the day is 2360-2434.

Cocudakl prices dropped as around 25 to 30 lakh bags of cottonseed cake are lying in Kadi, its more than estimated

Most of the active crushing mills in Kadi are only 7 to 8 mills

Considering the rise in binola and supply, the possibility of a fall in the coming days may be less market compelling.

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">