Cotton trading range for the day is 21670-22090 - Kedia Advisory

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

COTTON

Cotton yesterday settled down by -0.14% at 21820 tracking weakness in overseas prices amid chances of some rain in parts of Texas, but persistent concerns over supply kept prices on track for a weekly gain. The U.S. Department of Agriculture's weekly export sales report showed net sales of 63,700 running bales for 2020/2021, down 17% from the previous week and 56% from the prior 4-week average. Post forecasts India's MY 2021/22 cotton production will increase by four percent to 29.5 million 480 lb. bales on a reduced area of 12.9 million hectares. Yields are expected to improve by five percent based on the expectation of a normal monsoon forecast by the Indian Meteorological Department. In April, cotton fiber and yarn prices decreased due to a surge in COVID-19 cases, which has led to a slowdown in the production and consumption of textile products. Domestic retail demand remains severely hampered by the pandemic; however, exports of cotton and cotton products are rising, providing the best chance of recovery in the sector. The Committee on Cotton Production and Consumption expects production during the current season (October 2020 to September 2021) to be at 360 lakh bales, slightly lower than the 2019-2020 estimate of 365 lakh bales. In spot market, Cotton gained by 60 Rupees to end at 22150 Rupees.Technically market is under long liquidation as market has witnessed drop in open interest by -9.38% to settled at 7253 while prices down -30 rupees, now Cotton is getting support at 21740 and below same could see a test of 21670 levels, and resistance is now likely to be seen at 21950, a move above could see prices testing 22090.

Trading Idea for the day

Cotton trading range for the day is 21670-22090.

Cotton pared gains tracking weakness in overseas prices amid chances of some rain in parts of Texas

USDA’s weekly export sales report showed net sales of 63,700 running bales for 2020/2021, down 17% from the previous week

India's MY 2021/22 cotton production will increase by four percent to 29.5 million 480 lb. bales on a reduced area of 12.9 million hectares.

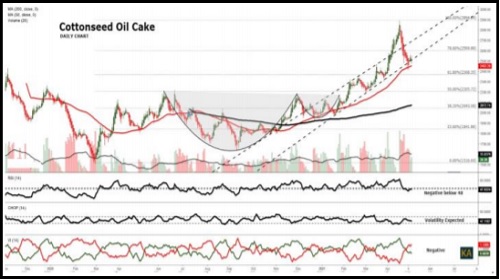

Cocudakl

Cocudakl yesterday settled up by 0.23% at 2614 due to a scarcity of cottonseed in spot markets, amid a broad rally in the edible oil complex. A sharp rally in the edible oil complex has also supported prices of cotton wash oil, as there is higher demand for cotton seed for crushing purposes. Waning arrivals of raw cotton due to the fag end of the season and limited stocks of cottonseed with ginners has led to a supply crunch in the market. India has produced around 36 mln bales in the ongoing 2020-21 (Oct-Sep) season, of which nearly 33 mln bales, or 92% of the stock, has already arrived in the market. Considering firm demand outlook for the commodity, the tight supply situation in cottonseed is expected to continue in the coming months as well as the new season for cotton will start only in October. Farmers may increase the area under cotton in the upcoming kharif season due to forecast of a good monsoon by the India Meteorological Department, as well as expectations of higher prices. Cottonseed production and quality were affected last year due to excessive rains in the key producing State of Telangana and some parts of Tamil Nadu. In Akola spot market, Cocudakl dropped by -0.45 Rupees to end at 2750 Rupees per 100 kgs.Technically market is under fresh buying as market has witnessed gain in open interest by 10.95% to settled at 77910 while prices up 6 rupees, now Cocudakl is getting support at 2567 and below same could see a test of 2521 levels, and resistance is now likely to be seen at 2647, a move above could see prices testing 2681.

Trading Idea for the day

Cocudakl trading range for the day is 2521-2681.

Cocudakl gained due to a scarcity of cottonseed in spot markets, amid a broad rally in the edible oil complex.

Cottonseed production and quality were affected last year due to excessive rains in Telangana and some parts of Tamil Nadu.

India has produced around 36 mln bales in the ongoing 2020-21 season, of which nearly 92% of the stock

To Read Complete Report & Disclaimer Click Here

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">