Copper prices are likely to remain under pressure on China sanctions and new lockdown in the EU By Abhishek Bansal, Abans Group

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

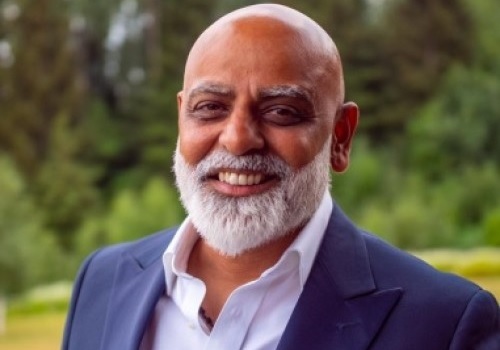

Below are Views On Copper prices are likely to remain under pressure on China sanctions and new lockdown in the EU By Mr. Abhishek Bansal, Founder Chairman, Abans Group

Copper prices are likely to remain under pressure on China sanctions and new lockdown in the EU

LME 3 M Copper prices are trading now trading near $8935 per mt which is sharply lower from the previous day’s high of $9144 per mt. A sell-off into equities, strength in the dollar index, and a drop in crude oil prices are weighing on the copper prices.

Tit-for-tat sanctions between China and the West have created geopolitical tension and likely to reduce metals demand if there is more acceleration from both ends. The United States, the European Union, Britain, and Canada imposed sanctions on Chinese officials for human rights abuses in Xinjiang and Beijing reciprocate same immediately by putting measures against the European Union.

Additionally, new coronavirus lockdowns in Europe have also reduced hope for faster economic recovery in the region. Germany and France are extending restrictions to prevent the rapid spread of the deadly coronavirus.

International copper study group released preliminary data for 2020 in its March 2021 report. It indicates that World mine production declined by 3.5% in April-May (y-o-y) as these two months were the most affected by the COVID-19 related global lockdown that resulted in temporary mine shut down, however, it started to recover in June as lockdown measures eased and the copper industry adapted to the stricter health protocols. World refined copper production increased by about 1.5% in 2020 with primary production (electrolytic and electrowinning) up by 2.8% and secondary production (from the scrap) down by 4.5%. World apparent refined copper usage increased by 2.2% in 2020. Among the biggest copper-using regions, refined usage fell by 15% in Japan, 11% in the EU, 5% in the United States, and about 10% in Asia (Ex-China). World refined copper balance for 2020 indicates an apparent deficit of about 560,000 t due to a strong Chinese apparent usage.

SHFE warehouse inventory report suggests that Copper stock has increased by 60944mt in the last one and now stands at 114919mt as of 23 March 2021. Also, LME Copper stock has increased by 48975mt and now stands at 122425mt as of 23rd March 2021.

Tuesday's U.S. economic data was mixed for base metals demand and copper prices. On the bearish side, Feb's new home sales tumbled -18.2% to a 9-month low of 775,000, against expectations of a decline to 870,000. Conversely, the March Richmond Fed manufacturing survey current conditions index rose +3 to 17, against expectations of 16, which is supportive for copper prices.

LME Copper 3 M prices are likely to find stiff resistance near $9053 per mt and $9235 per mt however it may find a strong support base around 50 days EMA at $8611

Silver to continue with the negative trend-

Silver prices trading near two weeks low due to strength in the dollar index. Fresh lockdown measures in Germany and France have also weighed on industrial metal demand and likely to keep silver prices under pressure. Concern about the third wave of Covid infections in Europe is likely to reduce industrial metals demand. German Chancellor Merkel on Tuesday said that Germany is "in a very, very serious situation" with Covid "case numbers rising exponentially and intensive-care beds filling up again." She said Germany will go into a hard lockdown during the Easter holiday for five days starting April 1, when all stores will be closed except for food stores.

Silver prices were also under pressure after hawkish comments from Dallas Fed President Kaplan when he said that the rise in Treasury yields over the past month is a healthy sign and he estimates the first Fed rate hike will be in 2022, which is more hawkish than the consensus Fed dot plot that signals no interest rate hike through 2023.

Also, Fed Chair Powell reduced inflation concerns when he said that "inflation will move up over the course of this year," due to pent-up demand and supply-chain bottlenecks, but "our best view is that the effect on inflation will be neither particularly large nor persistent." These comments are negative for precious metals which are used as a hedge against inflation.

Silver prices are likely to trade negatively while below key resistance level near 50 days EMA at $26.241 while it may find a strong support base around 200 days EMA at $24.731

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Quote on Aluminum update By Mr. Yash Sawant, Angel Broking Ltd